Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

Australian banks operate in an environment where precision is expected and delays are costly. Every invoice, settlement request, and supplier payment feeds into a larger financial ecosystem that depends on trust and timing. Accounts payable processing sits at the center of that ecosystem, quietly shaping cash flow stability, regulatory alignment, and vendor confidence. When transaction volumes climb, well-structured accounts payable operations give banking teams the clarity and control they need to keep everything moving smoothly.

Why Accounts Payable Operations Matter in Australian Banking

Banks manage a steady stream of payments tied to technology platforms, compliance services, property management, and professional vendors. Each payment passes through multiple checks before funds move. Accounts payable operations bring order to that complexity.

These operations define how invoices are received, verified, approved, and settled. In Australian banking, that structure matters. Clear workflows reduce friction between departments and keep finance teams aligned with governance standards. When processes are consistent, decision-makers gain confidence in the numbers they see every day.

Accounts Payable Operations and Australia’s Regulatory Landscape

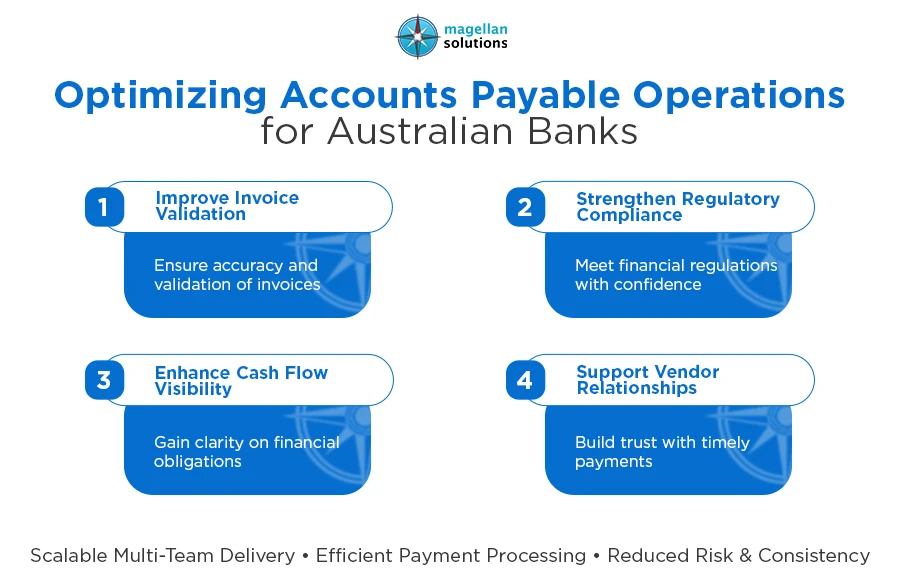

Regulation shapes every financial process inside a bank. Payables management system support compliance by embedding controls into daily workflows. Invoice validation, supplier authentication, and tax accuracy all happen before approvals move forward.

Australian banks rely on these controls to meet expectations set by APRA and ASIC. Detailed documentation and traceable approvals strengthen audit readiness. When reviews happen, finance leaders can point to clean records and well-defined processes instead of scrambling for explanations.

Accounts Payable Operations Create Discipline Around Invoice Accuracy

Invoice discrepancies slow everything down. They trigger back-and-forth communication, delay approvals, and disrupt payment schedules. Accounts payable management address this by enforcing consistent validation rules from the start.

Purchase order matching, pricing verification, and supplier data checks happen early in the process. Centralized handling ensures the same standards apply across departments. When exceptions appear, teams resolve them quickly because ownership and escalation paths are already clear.

Accounts Payable Operations at Scale for High-Volume Transactions

Transaction volume rarely stays flat in banking. Month-end cycles, vendor renewals, and large project rollouts create spikes that test internal capacity. Accounts payable support provide the structure needed to handle those surges without sacrificing accuracy.

Automation supports invoice capture and approval routing, while standardized queues keep work moving. Finance teams maintain predictable turnaround times even when volumes rise sharply. That consistency protects supplier relationships and internal service levels.

Accounts Payable Operations Improve Cash Flow Visibility

Clear cash flow insight starts with knowing what is owed and when payments will leave the business. Payables management system consolidate payment data across teams, giving finance leaders a single view of outstanding liabilities.

Real-time reporting highlights aging invoices, pending approvals, and scheduled disbursements. This visibility supports better forecasting and more confident liquidity planning. Decisions rely on facts rather than assumptions.

Accounts Payable Operations Strengthen Vendor Relationships

Vendors notice when payments arrive on time and remittance details are accurate. Accounts payable management create dependable payment experiences that build trust with suppliers.

Clear communication channels help resolve questions before they escalate into disputes. Consistent payment cycles signal reliability, which matters when banks depend on external partners for critical services. Strong vendor relationships support operational continuity and negotiated pricing stability.

Accounts Payable Operations Reduce Operational Risk

Manual handling introduces variability into financial workflows. Accounts payable management reduce that risk by defining approval hierarchies and access controls. Each role carries specific responsibilities, and segregation of duties remains enforced throughout the process.

Documented procedures support consistency even as teams change. Knowledge lives in the process, not in individual inboxes. That stability lowers exposure to errors and strengthens internal governance.

Accounts Payable Operations Support Digital Finance Initiatives

Digital transformation remains a priority across Australian banking. Payables management system align naturally with that shift. Integrated systems connect invoice management platforms with core finance software.

Digitized workflows shorten processing cycles and reduce paper dependency. Data captured during processing feeds analytics that reveal spending patterns and operational bottlenecks. Finance leaders use these insights to refine procurement strategies and manage costs more effectively.

Accounts Payable Operations and Workforce Productivity

Finance teams balance accuracy with speed under constant pressure. Accounts settlement processes support productivity by removing repetitive manual steps. Automated routing and standardized checks free teams to focus on oversight and exception handling.

Efficiency gains appear quickly. Teams process higher volumes without expanding headcount. That balance supports sustainable operations while maintaining financial discipline.

Accounts Payable Operations and Business Continuity Planning

Disruptions happen. Systems change, teams shift, and unexpected events test operational resilience. Accounts payable processes provide continuity through documented workflows and centralized systems.

Remote processing remains possible because approvals and data access stay secure and structured. Payment schedules continue without interruption. For Australian banks, that reliability protects reputation and stakeholder confidence.

Accounts Payable Operations Safeguard Financial Data

Data security sits at the core of banking operations. Business payables administration incorporate strict access controls, audit logs, and monitoring protocols. Sensitive payment information remains protected throughout the lifecycle.

Ongoing oversight strengthens fraud prevention and supports compliance requirements. Finance leaders gain assurance that controls operate consistently across every transaction.

Accounts Payable Operations as a Strategic Advantage

Business payables administration contribute insight beyond daily processing. Payment data informs budgeting decisions, supplier negotiations, and cost management initiatives. Finance leaders rely on this information to guide long-term planning.

When aligned with broader financial strategies, accounts payable systems support smarter decision-making across the organization. The function evolves into a source of operational intelligence.

Why Australian Banks Outsource Accounts Payable Operations

Many banks choose to outsource accounts payable systems to gain scale and specialization. External delivery models provide structured processes, experienced professionals, and consistent performance metrics.

Multi-agent, multi-seated delivery hubs support high transaction volumes without operational strain. Banks maintain service levels while redirecting internal resources toward core banking priorities.

How Magellan Solutions Supports Accounts Payable Operations

Magellan Solutions delivers accounts payable operations designed for Australian banking environments. Through a multi-FTE delivery model, dedicated teams manage invoice processing, validation, and payment workflows with precision.

These accounts payable processes align with regulatory expectations and internal governance standards. Structured processes, trained finance professionals, and secure systems support consistent outcomes across complex transaction volumes. Banks gain improved accuracy, faster cycle times, and operational resilience.

Take the Next Step Toward Stronger Financial Operations

Build Payment Confidence With a Proven Delivery Partner

Magellan Solutions supports Australian banks with accounts payable operations that scale reliably and perform consistently. A multi-agent delivery hub ensures continuity, accuracy, and compliance across high-volume financial processing.

Explore how Magellan Solutions can strengthen your accounts payable operations and support your broader financial objectives. Connect with the team today and start building a more resilient payment function.