Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

Small and mid-sized utility providers in Florida are under constant pressure to stay compliant with payment regulations while keeping operations running smoothly. That’s pushed many of them to explore bpo for accounts payable process solutions—not as an afterthought, but as a practical way to keep up with growing administrative demands. Between vendor contracts, government guidelines, and strict payment schedules, even a single delay can ripple through the business in costly ways.

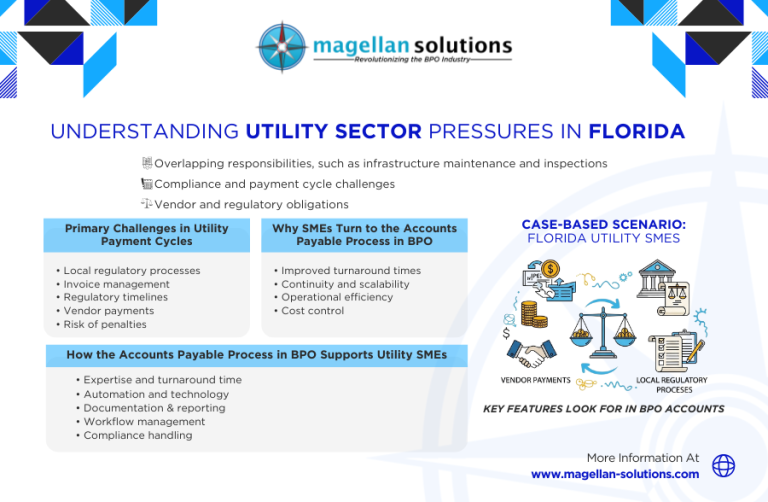

Understanding Utility Sector Pressures in Florida

Florida utilities don’t have the luxury of slow paperwork. Whether the company handles wastewater, electricity distribution, telecom infrastructure, or waste hauling, there’s a web of obligations that can’t be ignored. Vendors need to be paid on time. State and municipal agencies require accurate reporting. Some bills tie directly to licensing benchmarks and service commitments.

Most SMEs in this sector juggle multiple projects at once—equipment maintenance, environmental inspections, seasonal upgrades, repairs after storms, and subcontracted services. If the accounts payable function gets backed up or relies on error-prone manual work, there’s a real risk of late charges, compliance violations, or public service interruption.

Why SMEs Turn to the Accounts Payable Process in BPO

The accounts payable process in bpo gives smaller utility operators something they typically don’t have in-house: structure, bandwidth, and predictability. Instead of stretching a small accounting team across dozens of recurring tasks, outsourcing brings in specialists who already understand financial workflows.

Some of the biggest reasons utility SMEs lean on BPO support include:

- Cost control without new hires – Instead of expanding payroll or buying new software, companies tap into ready-made teams and systems.

- Improved consistency – Invoices and purchase approvals are handled through standardized, traceable processes.

- Scalability when workloads spike – Florida utilities often see seasonal swings, disaster recovery surges, or budget-year deadlines. BPO solutions flex with them.

- Faster processing – Payments move through reviews and approvals with fewer stalls, protecting relationships with suppliers.

Primary Challenges in Utility Payment Cycles

Utilities don’t just process bills—they answer to regulators, contractors, equipment suppliers, and third-party service providers working on strict timelines. Some of the recurring trouble spots include:

- Rigid deadlines tied to regulations – Late payments can affect license standing or trigger penalties.

- Multiple invoice formats – Vendors don’t use a single template, which slows down verification and approval.

- Manual entry mistakes – Small teams working with spreadsheets or legacy tools are more likely to miss details or duplicate transactions.

- Financial risk – A single overlooked invoice can compound into interest fees or strained contracts.

The accounts payable process in bpo offers structure designed to prevent these issues before they surface.

How the Accounts Payable Process in BPO Supports Utility SMEs

For organizations that can’t afford breakdowns in payments, outsourcing brings a level of discipline and visibility that’s hard to replicate internally. Here’s how the accounts payable process in bpo tends to reshape daily operations:

- Invoice capture and validation are often automated, removing the need for manual sorting and data input.

- Approval flows are pre-defined, keeping stakeholders accountable and decisions on schedule.

- Compliance monitoring stays active in the background, ensuring payments follow the right regulatory timelines.

- Reporting and tracking make audits and financial reviews less disruptive.

Where an internal team might struggle during busy seasons, outsourcing keeps documentation tight and timelines consistent.

Case-Based Scenario: Florida Utility SMEs in Action

Picture a mid-sized utility company in Central Florida handling water treatment and infrastructure upkeep. During hurricane season or after major storm events, invoices from contractors, inspectors, and equipment suppliers tend to spike. If the accounts payable team only has a few people, they’re forced to choose between accuracy and speed.

With the accounts payable process in bpo, every invoice is routed, verified, queued for approval, and logged without burying internal staff. Delays don’t snowball. Compliance obligations tied to environmental regulations stay intact.

Another example: a waste management company servicing multiple counties. Different municipalities operate with different cycles and billing rules. Outsourcing ensures each payment follows its respective terms, preventing misunderstandings with local government partners and subcontractors.

Comparing In-House Teams vs. BPO for Accounts Payable Process

Many Florida utilities still rely on lean in-house accounting teams, and while they know the organization well, they’re limited by time and resources. The contrast becomes obvious when stacking in-house processing against bpo for accounts payable process support.

In-House Limitations:

- Hiring, onboarding, and training take time and budget.

- Legacy systems and manual work increase stress during peak periods.

- Internal backlogs create blind spots in cash flow planning.

BPO Advantages:

- Ready access to experienced AP staff.

- Established workflows built for volume and compliance.

- Flexible scaling without recruitment headaches.

For an industry that can’t afford payment lapses, the appeal of outsourcing becomes practical rather than optional.

Key Features to Look For in BPO Accounts Payable Services

Not all providers offer the same depth of support. Utility SMEs should look closely at how a BPO partner handles security, visibility, and compliance. Here are a few must-haves:

- Audit-ready documentation

Every transaction needs a paper trail. That matters when regulators ask for proof or finance teams prepare annual reviews. - Automated routing and approvals

Manual sign-offs can stall payments. Automated workflows keep things moving without constant follow-ups. - Vendor communications support

Suppliers and contractors expect timely responses, and consistent communication helps avoid disputes. - Data protection protocols

Utility payment information isn’t just sensitive—it’s operationally critical. The provider should follow strict standards. - Real-time reporting and tracking

Finance leaders need dashboards or summaries that reflect actual spending, cash flow, and upcoming obligations.

When the accounts payable process in bpo aligns with a utility company’s internal rules and payment cycles, the impact is immediate.

Future Trends in AP Outsourcing for Utilities

Regulatory oversight, population growth, and infrastructure demands are all rising in Florida. As the landscape shifts, accounts payable outsourcing is also evolving. A few trends already shaping the future include:

- Machine learning and data capture automation to streamline invoice processing.

- Cloud-based AP platforms for easier collaboration across departments or remote sites.

- Paperless workflows that support environmental targets and reduce storage burdens.

- Built-in compliance trackers that alert teams to upcoming deadlines or changing rules.

The utilities that modernize their financial operations now will have a stronger footing as expectations tighten.

Conclusion: Why Choose a Trusted Partner

Florida’s SME utility providers can’t afford slow, error-prone payment systems when regulators, vendors, and local communities depend on timely action. Shifting the accounts payable process in bpo is less about cost-cutting and more about staying compliant, efficient, and ready for growth. When payment cycles align with regulatory standards and documentation is transparent, utility operations run with fewer surprises.

Magellan Solutions has spent years building AP support systems designed for industries that can’t miss a deadline. Its teams understand compliance demands, vendor management needs, and the realities of fluctuating workloads. For Florida utilities trying to streamline payment cycles without overextending internal staff, that kind of backing makes a measurable difference.

If you’re ready to stabilize your AP workflows and stay ahead of regulatory deadlines, visit Magellan-Solutions.com and explore how outsourcing can reinforce your financial operations.