Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

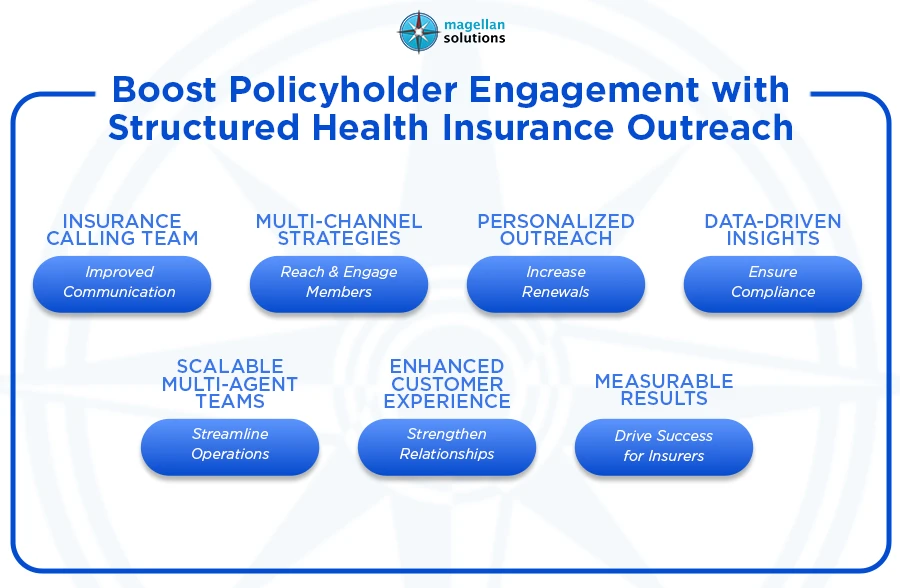

Health insurance outreach is key to keeping policyholders informed, satisfied, and engaged. When insurers reach out proactively, they not only clarify coverage details but also build trust that lasts. A professional insurance calling team makes this process seamless, giving every client the attention they deserve while managing high volumes efficiently.

Why Health Insurance Outreach Drives Results

Policyholders often miss important updates about benefits, wellness programs, or coverage changes. Structured health insurance outreach programs prevent those gaps by connecting insurers directly with their clients. This proactive communication keeps policies current, ensures claims go smoothly, and encourages members to use preventive care options.

Investing in outreach has measurable effects. Insurers see higher renewal rates, fewer service complaints, and stronger relationships with clients. A multi-agent insurance calling team handles these interactions at scale, keeping service consistent without overloading in-house staff.

Core Components of a Successful Health Insurance Outreach Program

1. Personalized Policyholder Segmentation

Not every policyholder needs the same message. Segmenting by age, coverage type, or communication preferences makes every call more relevant. Personalized outreach drives better engagement and ensures members feel understood rather than overlooked.

2. Multi-Channel Communication

Phone calls alone don’t cut it anymore. Combining calls with emails, SMS, and online portals gives policyholders multiple ways to connect. A skilled insurance calling team coordinates these channels so messaging stays consistent and clear.

3. Timely Education and Reminders

Members benefit from reminders about appointments, premiums, and claims deadlines. Sharing educational content about preventive care, wellness initiatives, and plan benefits helps policyholders make informed decisions while reducing administrative headaches.

4. Continuous Feedback and Analytics

Tracking metrics like call completion, responses, and satisfaction levels shows what’s working and what needs improvement. Insights from analytics allow insurers to fine-tune their health insurance outreach strategies for even better results.

Advantages of Working With an Insurance Calling Team

Outsourcing outreach to a professional insurance calling team brings significant advantages:

-

Scalable Support: Multi-agent teams handle thousands of policyholders without missing a beat.

-

Operational Efficiency: Outsourcing reduces overhead and eliminates the constant burden of hiring and training in-house staff.

-

Consistency and Compliance: Well-trained agents follow scripts and industry regulations, ensuring every interaction is professional.

-

Enhanced Customer Experience: Agents focus on relationship-building, providing personalized guidance and empathetic service.

These benefits combine to improve engagement, boost policyholder loyalty, and reduce strain on internal teams.

How Health Insurance Outreach Builds Stronger Engagement

Proactive health insurance outreach allows insurers to stay ahead of policyholder needs. Outreach teams can:

-

Remind members about renewals and coverage updates

-

Explain complex benefits in simple terms

-

Share tips for preventive health and wellness programs

-

Ensure claims and documentation are submitted accurately

By engaging clients consistently, insurers foster trust and satisfaction. Multi-agent insurance calling teams make it possible to maintain frequent, meaningful connections without losing efficiency.

Leveraging Technology in Health Insurance Outreach

Technology amplifies the impact of health insurance outreach:

-

CRM Tools: Track every policyholder interaction to personalize follow-ups.

-

Automated Dialers: Boost agent productivity and reduce wait times.

-

Analytics Dashboards: Measure outreach success in real time.

-

Secure Systems: Protect sensitive member data while maintaining compliance.

Integrating these tools allows insurance calling teams to deliver outreach that is timely, relevant, and compliant.

Best Practices for Effective Health Insurance Outreach

Insurance providers achieve stronger results by following proven practices:

-

Set Clear Objectives: Define measurable goals like engagement rates and policy renewals.

-

Train Agents Thoroughly: Multi-agent teams need ongoing training in communication, products, and compliance.

-

Use Data Wisely: Segment members and tailor outreach based on analytics.

-

Stay Compliant: Protect member data and follow all industry standards.

-

Monitor and Refine: Continually assess performance and adjust strategies for maximum impact.

Applying these principles ensures health insurance outreach produces consistent, tangible results.

Real-World Impact: Multi-Agent Teams in Action

An Australian insurer partnered with a multi-agent insurance calling team to handle outreach. Within six months, they saw:

-

35% increase in renewals

-

50% reduction in call center backlogs

-

Higher customer satisfaction scores thanks to proactive, clear communication

This shows how structured outreach programs, powered by professional health insurance outreach teams, improve both engagement and operational efficiency.

Choosing the Right Partner for Health Insurance Outreach

Picking the right partner for health insurance outreach is essential. Look for:

-

Experience: Teams familiar with insurance processes and compliance rules.

-

Scalability: Multi-agent operations capable of handling large policyholder bases.

-

Tech-Forward Approach: CRM and analytics tools that enhance outreach efforts.

-

Quality Assurance: Agents trained in communication, service, and compliance checks.

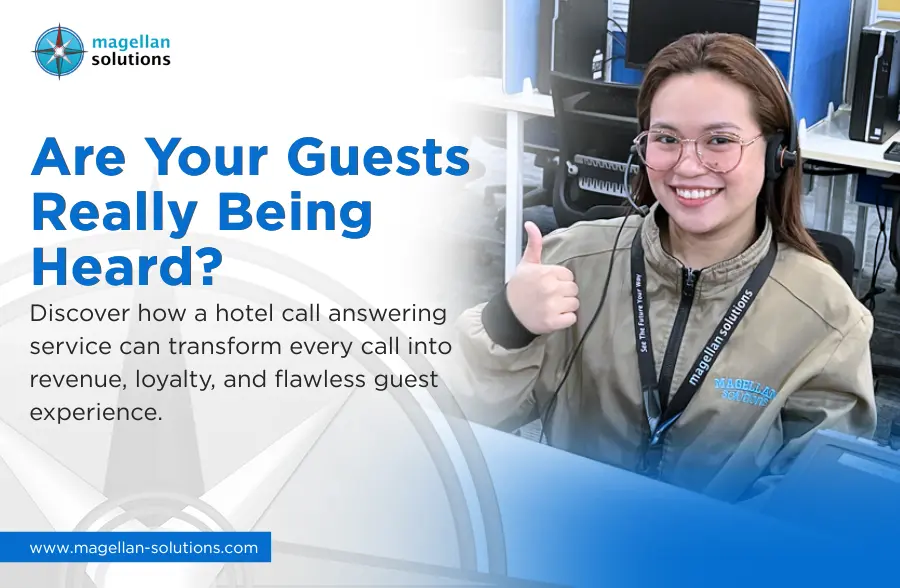

Magellan Solutions embodies these qualities, delivering scalable, reliable, and results-driven insurance calling team services for Australian insurers.

Take Your Policyholder Communication to the Next Level

Structured health insurance outreach improves satisfaction, strengthens relationships, and boosts operational efficiency. A multi-agent insurance calling team ensures every policyholder interaction is timely, relevant, and compliant. Magellan Solutions provides tailored outreach services that help insurers achieve measurable results without overextending internal teams.

Transform Your Health Insurance Outreach Today

Partner with Magellan Solutions’ multi-agent insurance calling team to elevate your outreach efforts. Visit Magellan-Solutions.com to see how our experts can streamline your operations, improve engagement, and help your policyholders get the clarity they need.