Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

Capital always plays an important part in businesses. If businesses want to expand, they must have access to capital. If businesses want to acquire important assets, they must also have access to capital. For matters involving loans, mortgages, and capital, lenders are the ones in charge. In the U.S., JPMorgan Chase Bank, Rocket Mortgage, and United Wholesale Mortgage are examples of successful lenders. However, many U.S. lenders struggle to manage loan closings effectively. Fortunately, conventional mortgage loan processing services are now available to help U.S. lenders. Thus, U.S. lenders should rely on mortgage processing teams to consistently achieve effective loan closings.

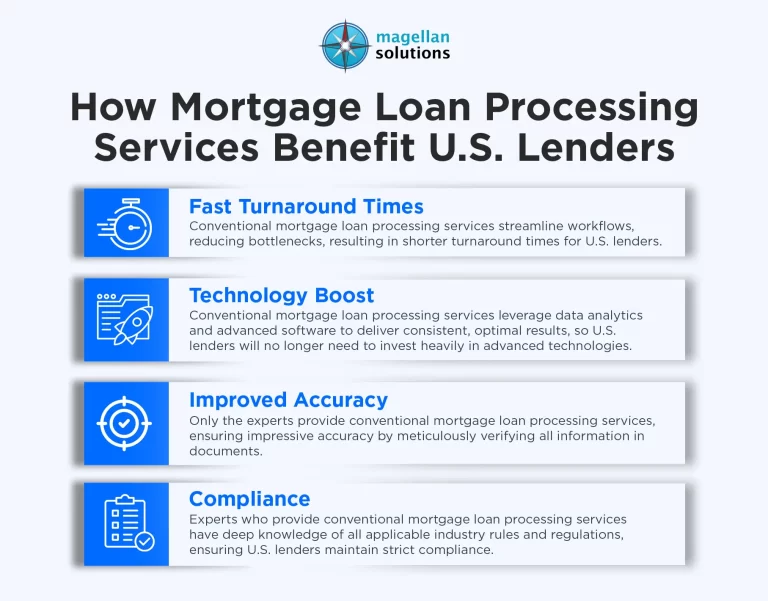

How Mortgage Loan Processing Services Benefit U.S. Lenders

- Fast Turnaround Times: Conventional mortgage loan processing services streamline workflows, reducing bottlenecks. Thus, U.S. lenders will experience shorter turnaround times, enabling them to achieve faster, consistent closings and sustain profitability.

- Technology Boost: Conventional mortgage loan processing services leverage data analytics and advanced software to deliver consistent, optimal results. Thus, U.S. lenders will no longer need to invest heavily in advanced technologies, as their outsourcing partner will handle them.

- Improved Accuracy: Only the experts provide conventional mortgage loan processing services, ensuring impressive accuracy. These experts meticulously verify all information in documents to ensure accuracy. Thus, U.S. lenders won’t have to worry about errors in the loan files that could cause unnecessary delays in loan closings.

- Compliance: Experts who provide conventional mortgage loan processing services have deep knowledge of all applicable industry rules and regulations. Thus, U.S. lenders can have peace of mind knowing they will always maintain strict compliance and reduce financial risk.

Why Choose Magellan Solutions for Mortgage Loan Processing Services?

- Expertise: We have expert agents in conventional mortgage loan compliance who can make a difference for U.S. lenders. Agents possess extensive knowledge and skills that they continually refine through rigorous training. We are confident that our agents can help U.S. lenders expedite loan closings.

- Cost Reduction: We aim to help U.S. lenders save substantial money by eliminating the need to hire and train additional personnel. Instead, U.S. lenders can just hire us as their outsourcing partner for conventional mortgage loan processing services to reduce costs. U.S. lenders will appreciate the cost savings they can prudently allocate in the future.

- Flexibility: We recognize that U.S. lenders experience fluctuating loan volumes. The advantage is that our conventional mortgage loan processing services are flexible enough to accommodate the needs of U.S. lenders. We consistently seek ways to assist U.S. lenders, regardless of circumstances.

- Collaborative Approach: We understand that U.S. lenders may have concerns about our conventional mortgage loan processing services. We are ready to collaborate with U.S. lenders to find out how we can help. We are confident we can meet U.S. lenders’ expectations through collaboration.

The Bottom Line

Conventional mortgage loan processing services for U.S. lenders produce excellent results. U.S. lenders should not hesitate to leverage outsourcing to realize its benefits. However, U.S. lenders must also choose the right outsourcing partner to maximize the benefits of outsourcing. U.S. lenders should select an outsourcing partner with an excellent track record and proven expertise to achieve the best results.

Interested in Mortgage Loan Processing Services?

Magellan Solutions is a provider of inbound and outbound call center services, as well as business processing outsourcing, in the Philippines. The company has extensive experience providing best-in-class outsourced solutions to small and medium-sized enterprises (SMEs) and large global enterprises. Combining unrivaled expertise and capabilities across industries and business functions, we bring fresh approaches to strategy and operational performance by delivering the right BPO and customer management solutions that span the entire customer lifecycle.

As a leading business process outsourcing provider of customer management solutions, we are committed to delivering an outstanding customer experience with every interaction. Visit Magellan-Solutions.com to learn more about our mortgage loan processing services. You can also contact us now and receive a complimentary 60-minute consultation.