Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

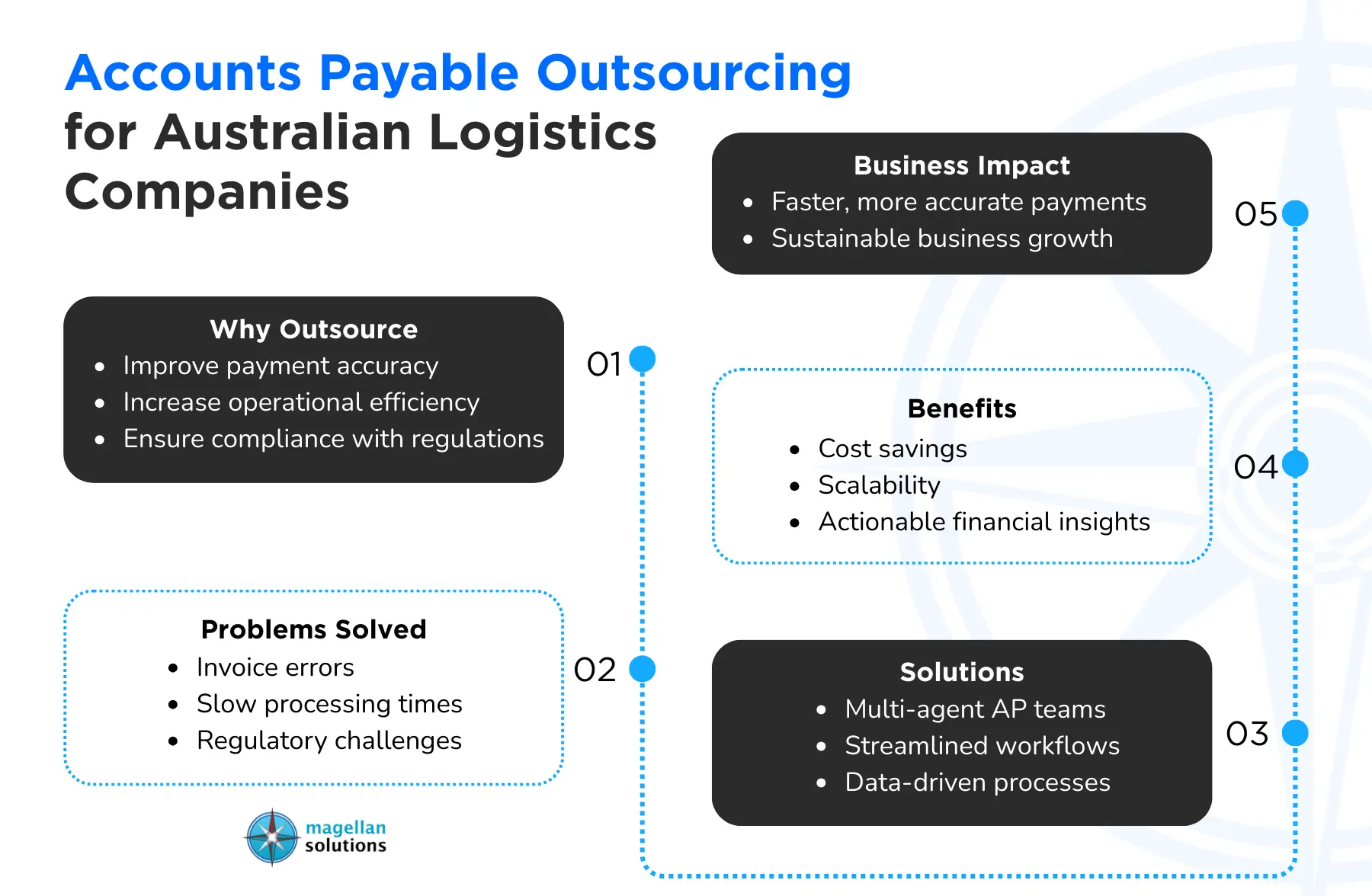

In today’s fast-paced logistics industry, managing financial transactions efficiently is crucial for operational success. Many logistics companies in Australia are turning to outsource accounts payable services for your business to streamline their financial processes, reduce errors, and maintain timely payments to suppliers and partners. Implementing accounts payable outsourcing services allows logistics companies to focus on core operations while experienced teams handle complex payment workflows.

This article explores how logistics companies can enhance payment accuracy and efficiency through accounts payable outsourcing, highlights key benefits, addresses common challenges, and provides actionable strategies to maximize the impact of outsourcing.

What is Accounts Payable Outsourcing Services

Accounts payable outsourcing services involve delegating an organisation’s invoice processing, vendor payments, and related financial tasks to an external service provider. These providers, such as Magellan Solutions, manage the end-to-end accounts payable workflow, including invoice verification, approval routing, payment scheduling, and reconciliation.

This approach ensures that payments are accurate, timely, and compliant with financial regulations. As businesses grow and transaction volumes increase, maintaining an in-house accounts payable team can become costly and prone to errors. Outsourcing provides a scalable, flexible solution that aligns with modern business needs.

Key Benefits of Accounts Payable Outsourcing Services

Logistics companies in Australia can leverage accounts payable outsourcing services to achieve several critical benefits:

1. Improved Payment Accuracy

Outsourced teams utilize multi-agent verification systems to reduce human errors and prevent duplicate or late payments. For example, logistics companies processing hundreds of invoices monthly see a measurable drop in payment discrepancies.

2. Faster Processing Time

By outsourcing routine AP tasks, companies can significantly accelerate invoice processing, allowing payments to suppliers to be completed promptly. This fosters stronger supplier relationships and avoids late fees.

3. Cost Efficiency

Maintaining an in-house AP team can involve high salaries, training, and technology expenses. Outsourcing converts fixed costs into variable expenses, allowing logistics companies to pay only for the services they need.

4. Enhanced Compliance

Experienced accounts payable service providers stay up to date with tax regulations, reporting requirements, and industry standards. This ensures logistics companies remain compliant while reducing audit risks.

5. Scalable Solutions

As transaction volumes fluctuate, outsourcing allows logistics companies to easily scale their AP operations without the burden of hiring additional staff or investing in new systems.

6. Data-Driven Insights

Many AP outsourcing services provide real-time reporting and analytics, enabling better cash flow management, budgeting, and strategic decision-making.

Common Challenges and Solutions

While accounts payable outsourcing brings numerous benefits, logistics companies may encounter certain challenges:

Challenge 1: Loss of Control

Some companies fear reduced oversight when outsourcing financial processes.

Solution: Implement clear communication channels, service-level agreements, and real-time reporting dashboards to maintain transparency and control.

Challenge 2: Data Security Concerns

Sensitive financial data is shared with external teams.

Solution: Partner with reputable providers like Magellan Solutions that employ secure systems, encryption protocols, and strict confidentiality measures.

Challenge 3: Integration with Existing Systems

Legacy accounting software may not easily sync with outsourced services.

Solution: Choose providers experienced in ERP integrations or cloud-based AP platforms that ensure smooth data transfer and workflow continuity.

Challenge 4: Vendor Resistance

Suppliers may prefer traditional payment methods and resist automated processes.

Solution: Develop a vendor onboarding strategy, provide training, and highlight the efficiency benefits of electronic payments.

Best Practices or Strategies

To maximize the effectiveness of accounts payable outsourcing services, logistics companies should adopt the following strategies:

-

Conduct a Needs Assessment: Identify volume, complexity, and current pain points in AP operations before selecting a provider.

-

Define Clear KPIs: Track metrics such as payment accuracy, processing time, and cost savings to measure outsourcing success.

-

Maintain Vendor Relationships: Even with outsourcing, ensure vendors are informed and satisfied with payment processes.

-

Leverage Automation Tools: Combine outsourcing with invoice scanning, OCR, and automated approval workflows for optimal efficiency.

-

Regular Reviews: Schedule periodic performance evaluations with the outsourcing provider to adjust processes and maintain continuous improvement.

Why Now is the Best Time to Invest in Accounts Payable Outsourcing Services

The logistics sector in Australia is growing rapidly, with increasing demand for faster, error-free financial operations. Emerging technologies such as cloud-based AP software and AI-powered invoice processing are enabling companies to streamline payments like never before.

Investing in accounts payable outsourcing services now allows logistics companies to:

-

Reduce operational costs while improving accuracy

-

Focus on core business activities such as transportation and supply chain management

-

Gain a competitive advantage through faster supplier payments and stronger financial control

According to industry reports, companies that adopt outsourced AP services can see up to 40% faster invoice processing and a 25% reduction in operational costs within the first year of implementation.

Conclusion

For logistics companies in Australia, accounts payable outsourcing services offer a reliable solution to improve payment accuracy, reduce operational costs, and enhance compliance. Outsourcing accounts payable functions to expert teams allows businesses to focus on strategic growth while ensuring timely and accurate financial transactions.

Interested in accounts payable outsourcing services? Magellan Solutions provides comprehensive accounts payable outsourcing solutions with skilled multi-agent teams, advanced technology integration, and strict data security protocols. Trusted by businesses across Australia, Magellan Solutions ensures efficiency, accuracy, and scalability in your financial operations.

Visit www.magellansolutions.com for a free consultation and learn how your logistics company can benefit from professional accounts payable outsourcing services.