Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

Owning a property, especially a house, is a top priority for many people. Thus, it should no longer be surprising that most people who want to own their own homes get a mortgage. People work hard to make regular mortgage payments because the feeling of owning their own homes is incredible. The best part here is that insurance-linked lenders exist to help people handle their mortgages effectively. However, a major challenge insurance-linked lenders face is effectively managing documentation, verification, and compliance. Fortunately, loan processing support for businesses is already available for insurance-linked lenders. Thus, insurance-linked lenders should leverage mortgage loan processing services to improve their productivity and efficiency.

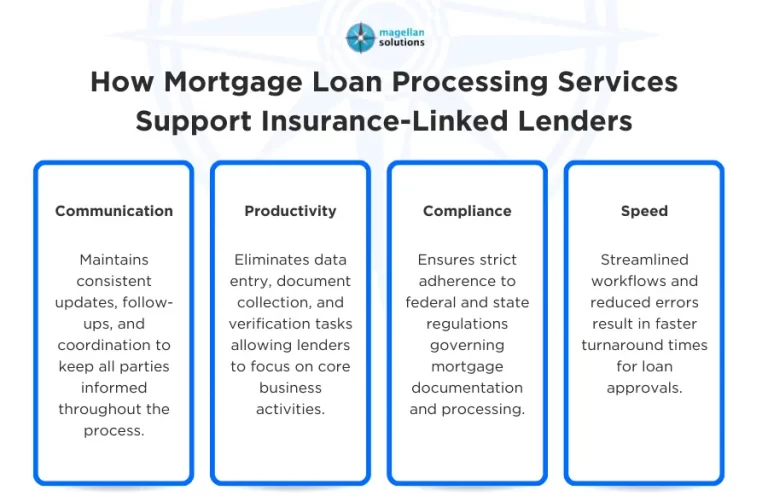

How Mortgage Loan Processing Services Support Insurance-Linked Lenders

- Efficiency Boost: Insurance-linked lenders won’t have to worry about data entry, document collection, and verification tasks anymore. Instead, insurance-linked lenders can rely on mortgage loan processing services to boost efficiency. Thus, insurance-linked lenders will have more time to focus on core activities.

- Strict Compliance: When insurance-linked lenders rely on mortgage loan processing services, they can expect strict adherence to all documentation requirements. The providers of these services are always fully aware of federal and state regulations regarding documentation, ensuring full compliance.

- Faster Turnaround Times: Mortgage loan processing services achieve faster turnaround times by reducing errors and improving workflows. Customers of insurance-linked lenders will appreciate faster processing of their mortgage loan applications, leading to greater satisfaction.

- Effective Communication: Mortgage loan processing services involve constant communication, including timely updates and follow-ups. An effective communication process ensures that mortgage loan applicants and insurance-linked lenders are fully aware of the latest developments. Thus, all parties involved are always aware of what is happening.

Why Choose Magellan Solutions for Mortgage Loan Processing Services?

- Expertise: We have expert agents in mortgage loan processing services with impeccable knowledge, skills, and experience. Our agents undergo extensive training as part of their continuous improvement. Thus, insurance-linked lenders can have confidence in hiring us as their outsourcing partner, given our expertise.

- Cost Savings: It is too costly and exhausting for insurance-linked lenders to hire additional staff to process mortgage loans. Instead, insurance-linked lenders can just rely on our mortgage processing services to reduce costs. Insurance-linked lenders will appreciate significant cost savings, which they can allocate wisely in the future.

- Scalability: We know that insurance-linked lenders experience periods when they must process high volumes of mortgage loan applications. The good news is that our mortgage loan processing is scalable enough to meet the needs of insurance-linked lenders. Thus, insurance-linked lenders can rest assured that we will always find ways to support them, no matter the circumstances.

- Collaborative Approach: We understand that insurance-linked lenders may have concerns about our mortgage loan processing. We are ready to collaborate with insurance-linked lenders to know their situation and how we can help. We are confident that we can make a difference for insurance-linked lenders through collaboration.

The Bottom Line

Mortgage loan processing services for insurance firms are reliable enough. Insurance-linked lenders must begin to appreciate the significant benefits of outsourcing. However, insurance-linked lenders must also choose the right outsourcing partner to reap the benefits. It would be smart for insurance-linked lenders to choose an outsourcing partner with impeccable credentials and a proven track record.

Interested in Mortgage Loan Processing Services?

Magellan Solutions is a provider of inbound and outbound call center services, as well as business processing outsourcing, in the Philippines. The company has extensive experience providing best-in-class outsourced solutions to small and medium-sized enterprises (SMEs) and large global enterprises. Combining unrivaled expertise and capabilities across industries and business functions, we bring fresh approaches to strategy and operational performance by delivering the right BPO and customer management solutions that span the entire customer lifecycle.

As a leading business process outsourcing provider of customer management solutions, we are committed to delivering an outstanding customer experience with every interaction. Visit Magellan-Solutions.com to learn more about our loan processing services. You can also contact us now and receive a complimentary 60-minute consultation.