Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

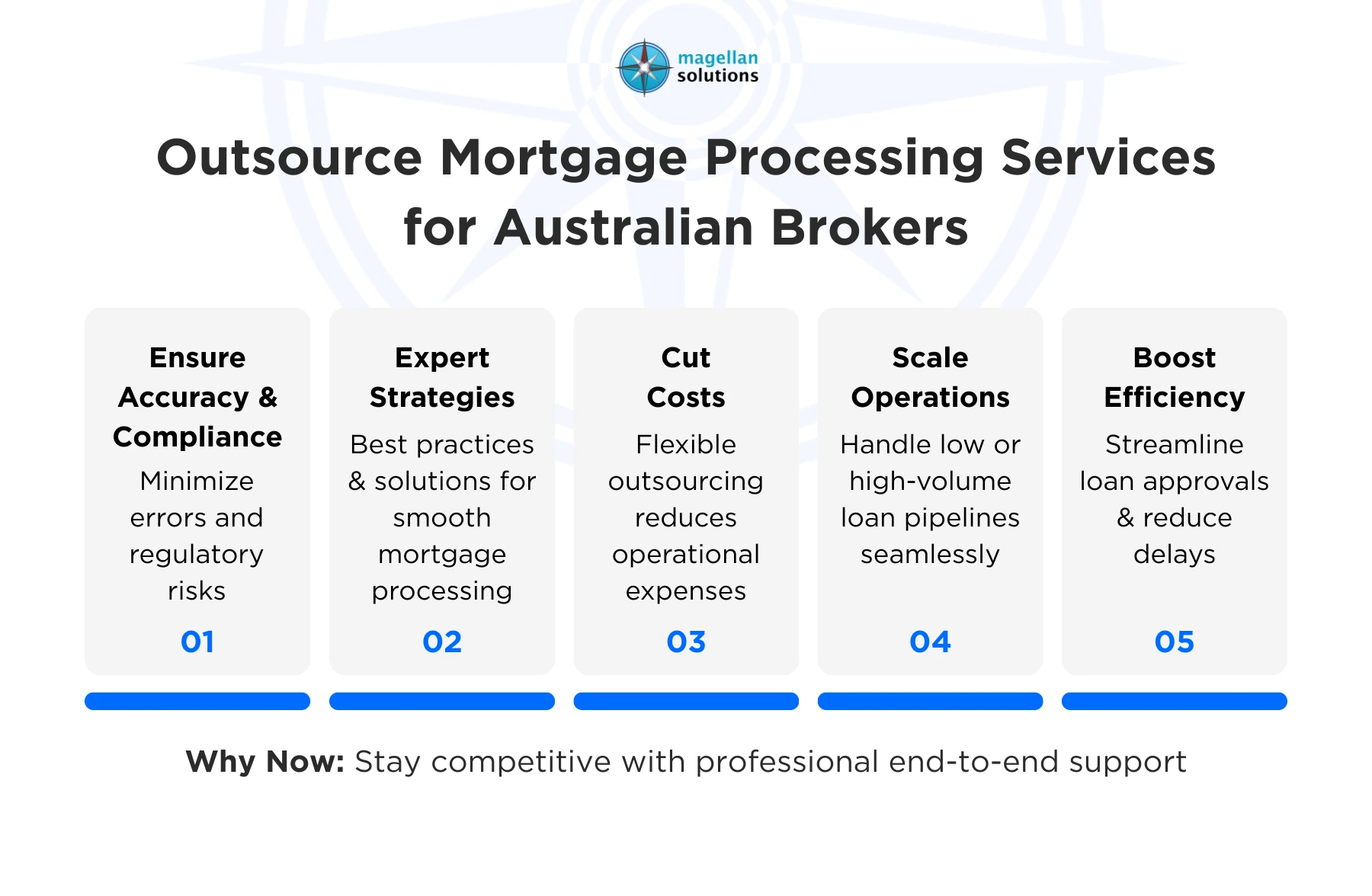

In today’s competitive mortgage market, professional support for end-to-end mortgage operations has become a crucial differentiator for Australian financial brokers. The growing demand for efficiency, accuracy, and faster loan processing has prompted many brokers to explore outsource mortgage processing services. This approach allows firms to handle both low and high-volume loan pipelines with precision while focusing on core business functions.

This article explores what mortgage processing outsourcing entails, why it has become an industry necessity, and how financial brokers in Australia can leverage it to streamline operations, reduce costs, and improve client satisfaction. By understanding the benefits, challenges, and best practices, brokers can make informed decisions to elevate their business performance.

What is Outsource Mortgage Processing Services

Outsource mortgage processing services refers to the practice of delegating mortgage-related administrative and operational tasks to a third-party service provider. These tasks can include application verification, documentation review, loan calculations, credit assessments, and compliance checks.

The outsourcing model works by allowing brokers to submit loan applications to a specialized team that manages the end-to-end processing. This approach ensures faster turnaround times, reduces operational bottlenecks, and allows brokers to focus on client relationships and business growth.

In Australia, the demand for mortgage processing outsourcing has increased due to the complexity of loan regulations, rising customer expectations, and the need to efficiently manage large volumes of applications.

Key Benefits of Outsource Mortgage Processing Services

Financial brokers can gain multiple advantages by integrating outsourced mortgage processing into their operations:

1. Enhanced Efficiency

Outsourcing streamlines loan processing workflows, reducing delays in documentation and approval. Brokers can process more loans in less time without compromising accuracy.

2. Cost Savings

Hiring and training in-house processing staff can be expensive. Outsourcing offers flexible solutions, allowing brokers to pay for services as needed, minimizing overhead costs.

3. Improved Accuracy and Compliance

Professional outsourcing providers are well-versed in Australian mortgage regulations. This reduces the risk of errors, non-compliance penalties, and customer dissatisfaction.

4. Scalability

Whether managing a small pipeline or high-volume loan applications, outsourced services can scale up or down according to demand, providing operational flexibility.

5. Focus on Core Business

By offloading processing tasks, brokers can dedicate more time to client acquisition, financial advisory, and relationship management.

6. Access to Advanced Technology

Outsourcing partners often utilize state-of-the-art mortgage processing platforms and tools, ensuring faster processing and better data management.

Common Challenges and Solutions

While outsourcing mortgage processing offers numerous benefits, brokers may face certain challenges:

Challenge 1: Data Security Concerns

Financial brokers handle sensitive client information, making data security paramount.

Solution: Work with reputable outsourcing providers like Magellan Solutions that adhere to strict data protection protocols, including encryption, secure servers, and compliance with Australian privacy laws.

Challenge 2: Integration with Existing Systems

Seamless integration with a broker’s current CRM and loan management systems can be complex.

Solution: Choose providers experienced in system integration, offering customizable workflows and real-time reporting to ensure smooth operational continuity.

Challenge 3: Maintaining Control and Oversight

Outsourcing may create concerns about losing operational control.

Solution: Implement clear communication channels, regular performance reviews, and defined SLAs to maintain oversight and quality standards.

Challenge 4: Initial Transition Period

Switching from in-house processing to outsourcing may temporarily affect workflow efficiency.

Solution: Plan a phased transition with pilot projects, staff training, and collaborative setup processes to ensure a smooth adaptation.

Best Practices or Strategies

To maximize the benefits of outsourced mortgage processing, Australian brokers should consider the following strategies:

1. Select a Credible Partner

Choose a provider with proven experience, industry certifications, and a track record in handling Australian mortgage applications.

2. Define Clear Processes

Establish detailed workflows, responsibilities, and reporting structures to minimize miscommunication and ensure consistency.

3. Leverage Technology

Use integrated loan management platforms to monitor progress, generate reports, and enhance collaboration with the outsourcing team.

4. Maintain Open Communication

Regular meetings, updates, and feedback loops help maintain quality and ensure the provider aligns with your business objectives.

5. Monitor Performance Metrics

Track turnaround times, error rates, compliance adherence, and customer satisfaction to assess ROI and continuously improve operations.

Why Now is the Best Time to Invest in Outsource Mortgage Processing Services

The mortgage industry in Australia is rapidly evolving, with stricter compliance requirements, increasing loan applications, and higher client expectations. Financial brokers who adopt outsource mortgage processing services now can gain a competitive advantage, reduce operational strain, and achieve faster growth.

Recent trends indicate that brokers using outsourced solutions experience up to 40% faster processing times and significant reductions in errors. With the rise of digital mortgage platforms and automation, partnering with a specialized provider ensures brokers stay ahead in efficiency, accuracy, and client service.

Conclusion

In summary, outsource mortgage processing services provide Australian financial brokers with the operational support required to manage loan pipelines efficiently, ensure compliance, and focus on client growth. By embracing professional support for end-to-end mortgage operations, brokers can scale their business, reduce costs, and enhance service quality.

Interested in outsourcing your mortgage processing services? Magellan Solutions offers comprehensive, secure, and reliable mortgage processing solutions tailored for Australian brokers. With years of industry experience and a team of skilled professionals, Magellan Solutions ensures accuracy, compliance, and efficiency for every loan processed.

Visit www.magellan-solutions.com for a free consultation and discover how outsourced mortgage processing can transform your brokerage operations.