Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

Across Asia-Pacific, finance platforms are under constant pressure to move faster while staying precise. Loan volumes keep rising, regulatory checks grow stricter, and customers expect quick, seamless decisions. In this environment, BPO loan support plays a central role in keeping operations efficient. The real accelerator behind this support structure is automated loan processing, which brings speed, clarity, and control to complex loan workflows.

This article takes a closer look at how automated loan processing reshapes loan operations in the APAC region, how it strengthens BPO loan support models, and why finance leaders rely on it to sustain growth without operational drag.

Why Automated Loan Processing Matters for Asia-Pacific Finance Platforms

Asia-Pacific lending ecosystems operate at scale and across borders. A single loan portfolio may involve multiple currencies, languages, and regulatory requirements. Automated loan processing provides a structured way to manage that complexity.

By digitizing loan intake, validation, and workflow routing, automated loan processing creates consistency across every transaction. Applications follow predefined paths. Required documents are flagged instantly. Exceptions surface early, when they are easier to resolve. This approach supports finance platforms that need predictability and speed at the same time.

For organizations using BPO loan support, automation establishes a shared operating framework. External teams work inside the same systems as internal stakeholders, which keeps execution aligned and measurable.

Automated Loan Processing as the Backbone of Modern BPO Loan Support

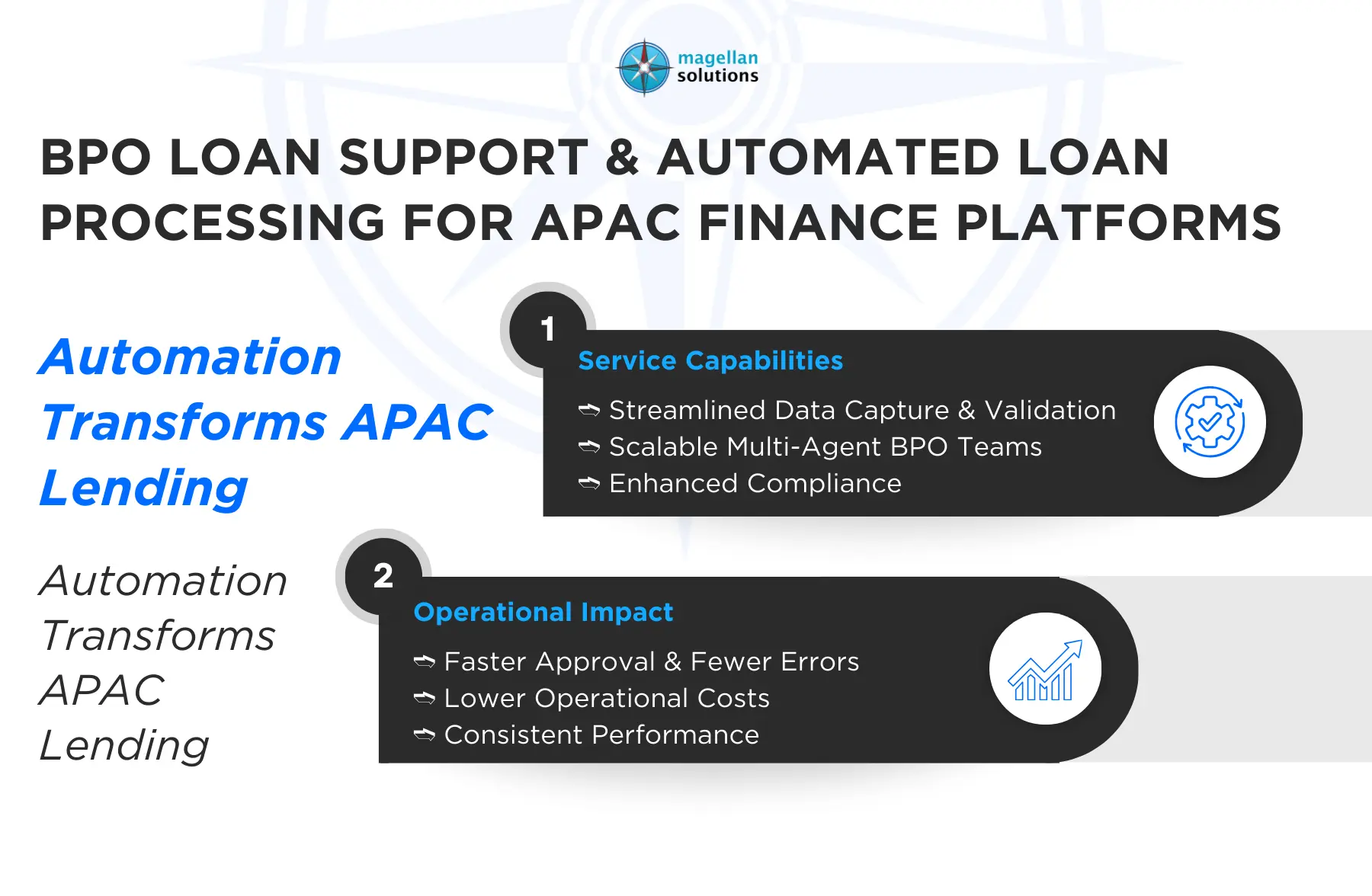

BPO loan support teams handle tasks that demand accuracy and pace. These include application review, document checks, data validation, and coordination with underwriting teams. Automated loan processing sharpens each of these functions.

Instead of relying on spreadsheets or email-based handoffs, automation assigns tasks through system-driven queues. Agents know exactly what to work on next. Supervisors track workloads in real time. Performance metrics reflect actual throughput, not estimates.

This structure allows BPO loan support teams to operate smoothly across shifts and time zones, a major advantage for Asia-Pacific platforms that serve regional and global markets.

Faster Loan Decisions Through Automated Loan Processing

Speed shapes customer experience in lending. Delays lead to drop-offs and lost opportunities. Automated loan processing accelerates decision-making by removing friction from every stage of the workflow.

Digital intake tools capture borrower data in structured formats. Validation rules check completeness and consistency the moment an application is submitted. If something is missing, the system flags it immediately. BPO loan support teams can then act without waiting for manual reviews.

Underwriting support also benefits. Automated calculations and rule-based assessments prepare clean data sets for credit teams, which shortens review cycles. For high-volume lenders, this speed translates directly into higher conversion rates.

Accuracy and Consistency at Scale

Loan processing errors create ripple effects. They delay approvals, trigger compliance issues, and undermine trust. Automated loan processing improves accuracy by design.

Every data field follows predefined logic. Financial figures align with system rules. Document requirements reflect regulatory standards by market. BPO loan support teams work with validated inputs instead of raw, unstructured information.

Consistency becomes easier to maintain, even as loan volumes increase. This reliability supports long-term portfolio health and reduces the need for corrective work downstream.

Strengthening Compliance Across APAC Markets

Compliance in Asia-Pacific lending requires attention to detail. Regulations vary widely across countries, and documentation standards change often. Automated loan processing embeds compliance into daily operations.

Systems enforce required checks based on jurisdiction. Audit trails record every action taken on a loan file. Access controls limit who can view or modify sensitive data. These safeguards protect finance platforms and their customers.

For BPO loan support teams, automated compliance rules remove ambiguity. Agents follow clear workflows that align with regulatory expectations, which reduces risk and supports governance objectives.

Automated Loan Processing and Data Visibility

Data drives decision-making in modern finance. Automated loan processing generates clean, structured data at every stage of the loan lifecycle.

This visibility supports accurate reporting, portfolio analysis, and forecasting. Finance leaders gain insight into approval timelines, bottlenecks, and risk indicators. BPO loan support performance becomes easier to evaluate through system dashboards rather than manual reports.

Clear data also supports strategic planning. When leaders understand where time and resources go, they can refine processes and allocate teams more effectively.

Scaling Loan Operations Without Losing Control

Growth across Asia-Pacific often happens quickly. New products launch. New markets open. Loan volumes spike. Automated loan processing supports this expansion by creating repeatable workflows that scale with demand.

When paired with a multi-agent, multi-seated BPO loan support model, automation allows teams to grow without disrupting service quality. New agents onboard faster because systems guide their work. Supervisors maintain oversight through centralized dashboards.

This scalability allows finance platforms to respond to market opportunities without compromising accuracy or turnaround times.

Integrating Automated Loan Processing Into Existing Systems

Automation delivers the best results when it connects seamlessly with current finance infrastructure. Automated loan processing integrates with accounting systems, core banking platforms, and CRM tools through secure data connections.

This integration eliminates duplicate data entry and reduces handoffs between departments. BPO loan support teams work within unified environments that reflect real-time information.

For Asia-Pacific finance platforms, integration supports end-to-end visibility, from loan origination through servicing and reporting. Operations feel cohesive rather than fragmented.

Cost Efficiency Through Smarter Processing

Operational efficiency matters as much as growth. Automated loan processing reduces costs by increasing throughput and minimizing rework.

BPO loan support teams equipped with automation handle higher volumes per agent. Error rates decline. Approval timelines shorten. These gains lower the cost per loan processed while maintaining service standards.

Over time, reduced compliance risks and fewer processing errors contribute to meaningful savings, which strengthens overall financial performance.

Practical Steps for Adopting Automated Loan Processing

Successful implementation depends on preparation and clarity.

Start by mapping existing loan workflows to identify pain points and automation opportunities. Define clear roles for BPO loan support teams within the new system. Deploy automation in phases to ensure stability and adoption. Monitor performance metrics closely to refine processes as volumes grow.

This structured approach helps finance platforms unlock value quickly while maintaining operational discipline.

Automated Loan Processing as a Competitive Advantage in APAC

Asia-Pacific lending markets reward speed, reliability, and consistency. Automated loan processing supports all three. Finance platforms that adopt it deliver faster decisions, maintain compliance, and scale with confidence.

BPO loan support teams become strategic contributors rather than task-based resources. Their work aligns with system logic and business goals, which strengthens overall performance.

As digital expectations continue to rise, automated loan processing stands as a core capability for competitive finance operations.

Build High-Performance Loan Operations With the Right Partner

Turn Automation Into Measurable Results

Automated loan processing reaches its full potential when supported by experienced outsourcing teams. Magellan Solutions delivers structured BPO loan support through a multi-agent, multi-seated operating model designed for high-volume accounting and finance workflows.

By combining process automation expertise with dedicated loan support teams, Magellan Solutions helps Asia-Pacific finance platforms accelerate approvals, strengthen compliance, and scale operations with confidence.

Visit Magellan-Solutions.com to learn how automated loan processing and enterprise-grade BPO loan support can elevate your loan workflows and drive sustainable growth.