Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

U.S. residential developers are increasingly looking to outsource home loan mortgage support to maintain efficiency and accelerate approvals. With rising demand for housing and stricter lending requirements, a streamlined home loan mortgage process has become a critical component for developers aiming to close deals faster and minimize processing delays.

This article explores how developers in the U.S. are leveraging multi-agent teams to optimize their mortgage workflow. We will discuss the definition of the home loan mortgage process, its benefits, common challenges, practical solutions, and why now is the ideal time for developers to invest in specialized support.

What is the Home Loan Mortgage Process

The home loan mortgage process refers to the comprehensive series of steps involved in evaluating, approving, and disbursing a mortgage loan for a residential property. It begins with the application and document submission, followed by credit and background verification, property appraisal, underwriting, and finally, loan approval and disbursement.

Over the years, this process has evolved into a highly regulated, multi-step procedure, requiring accuracy, speed, and attention to detail. For U.S. residential developers, a smooth mortgage process ensures quicker property turnover, reduced bottlenecks, and increased client satisfaction.

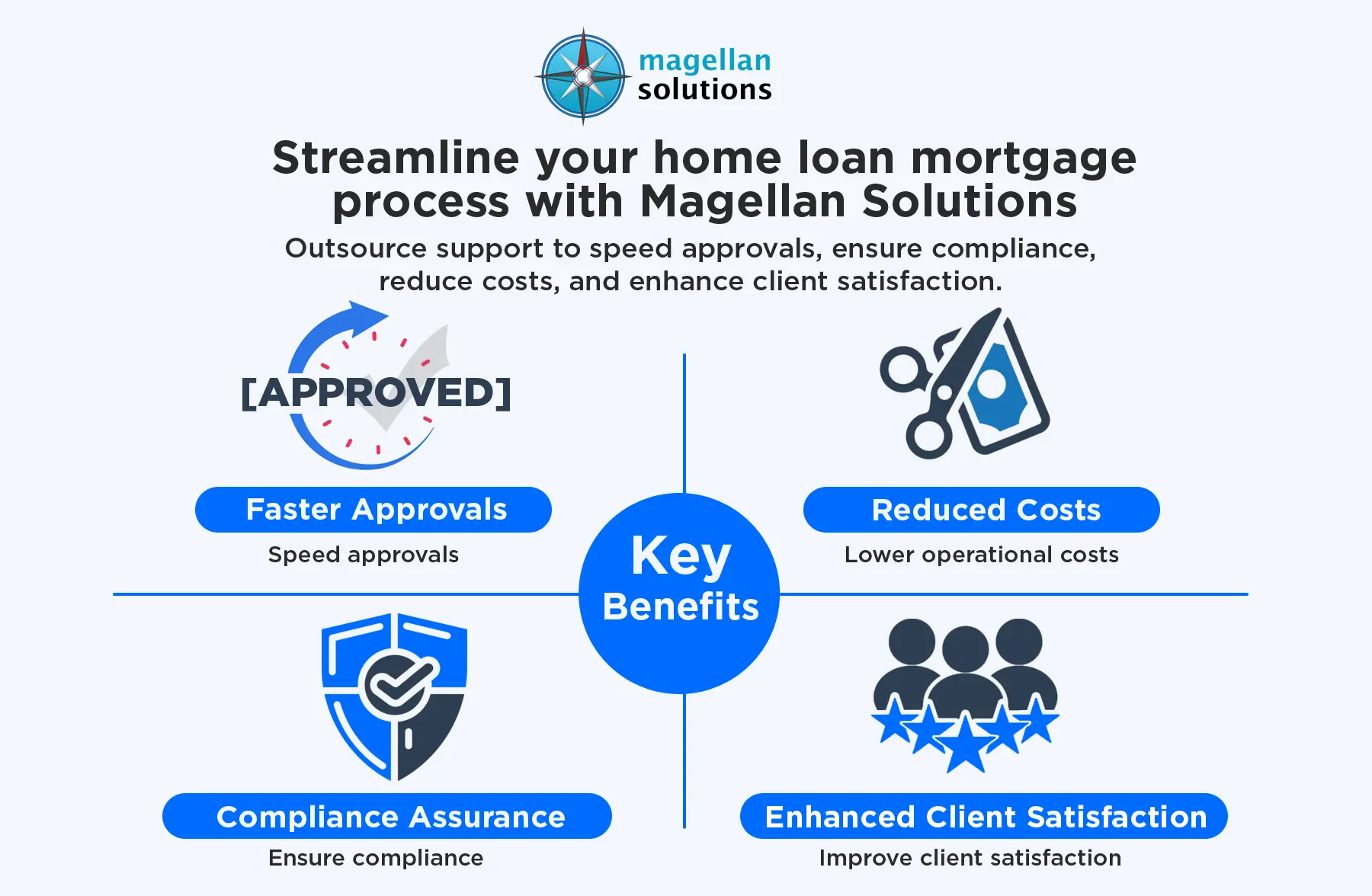

Key Benefits of the Home Loan Mortgage Process

Implementing a structured home loan mortgage process provides developers with multiple advantages:

1. Faster Loan Approvals

By standardizing document collection and verification, developers can significantly reduce approval times, allowing clients to secure financing quickly.

2. Reduced Operational Bottlenecks

Multi-agent support teams handle parallel tasks, ensuring that no step delays the overall process. This improves workflow efficiency and decreases manual errors.

3. Enhanced Client Satisfaction

A clear and smooth mortgage process boosts confidence among buyers, increasing the likelihood of repeat business and referrals.

4. Compliance Assurance

Proper handling of mortgage documentation ensures compliance with federal and state regulations, reducing legal risks and financial penalties.

5. Cost Efficiency

Outsourcing mortgage support reduces the need for extensive in-house staffing, lowering operational costs while maintaining high-quality service.

6. Scalable Operations

Developers can handle larger project volumes without compromising service quality, thanks to scalable multi-agent support.

Common Challenges and Solutions

While the benefits are clear, developers often face challenges in managing the home loan mortgage process. Here are some of the most common issues and practical solutions:

Challenge 1: Slow Documentation Verification

Manual verification of borrower documents can delay approvals.

Solution: Adopt a dedicated support team to manage document review, ensuring accuracy and speed without overburdening in-house staff.

Challenge 2: Inefficient Communication

Lack of coordination between developers, lenders, and clients can cause delays.

Solution: Implement a centralized communication platform for seamless updates and real-time tracking of mortgage applications.

Challenge 3: Regulatory Compliance Issues

Errors in compliance can result in fines or rejected applications.

Solution: Outsource to experienced mortgage support providers who are familiar with U.S. federal and state regulations, ensuring adherence at every step.

Challenge 4: Limited Scalability

Growing project portfolios can overwhelm internal teams.

Solution: Scale operations through multi-agent teams that provide flexible support based on project demands.

Best Practices or Strategies

For developers looking to optimize their home loan mortgage process, these expert strategies can improve efficiency and outcomes:

1. Invest in Multi-Agent Teams

Leverage specialized agents to handle documentation, verification, and follow-ups. This ensures parallel processing and faster approvals.

2. Use Technology to Automate Workflows

Adopt digital tools for document management, e-signatures, and progress tracking to minimize manual errors and save time.

3. Prioritize Training and Knowledge Updates

Ensure that all support staff are regularly trained on compliance changes and best practices to maintain quality and accuracy.

4. Standardize Process Documentation

Create clear guidelines and checklists for every step in the mortgage process to avoid inconsistencies and streamline approvals.

5. Maintain Transparent Communication with Clients

Keep borrowers informed at every stage, which reduces confusion and strengthens trust.

Why Now is the Best Time to Invest in Home Loan Mortgage Process

The U.S. residential market is currently experiencing high demand, stricter lending regulations, and increased buyer expectations. According to recent data, mortgage approval times have been a major bottleneck for developers, with delays affecting project turnover and client satisfaction.

By investing in structured home loan mortgage support, developers can capitalize on market growth, reduce operational strain, and deliver faster, compliant, and cost-effective mortgage processing. With competition intensifying, adopting a multi-agent approach now ensures developers remain ahead of industry trends and buyer expectations.

Conclusion

A well-implemented home loan mortgage process is essential for U.S. residential developers looking to accelerate approvals, maintain compliance, and enhance client satisfaction. Outsourcing mortgage support through specialized teams offers tangible benefits such as faster processing, reduced costs, and scalable operations.

Interested in improving your home loan mortgage process? Magellan Solutions provides professional outsourcing services designed to streamline mortgage support, reduce bottlenecks, and ensure compliance for developers across the U.S. With extensive experience and a dedicated multi-agent workforce, Magellan Solutions enables faster approvals and improved operational efficiency.

Visit www.magellan-solutions.com for a free consultation and discover how your mortgage process can achieve maximum efficiency.