Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

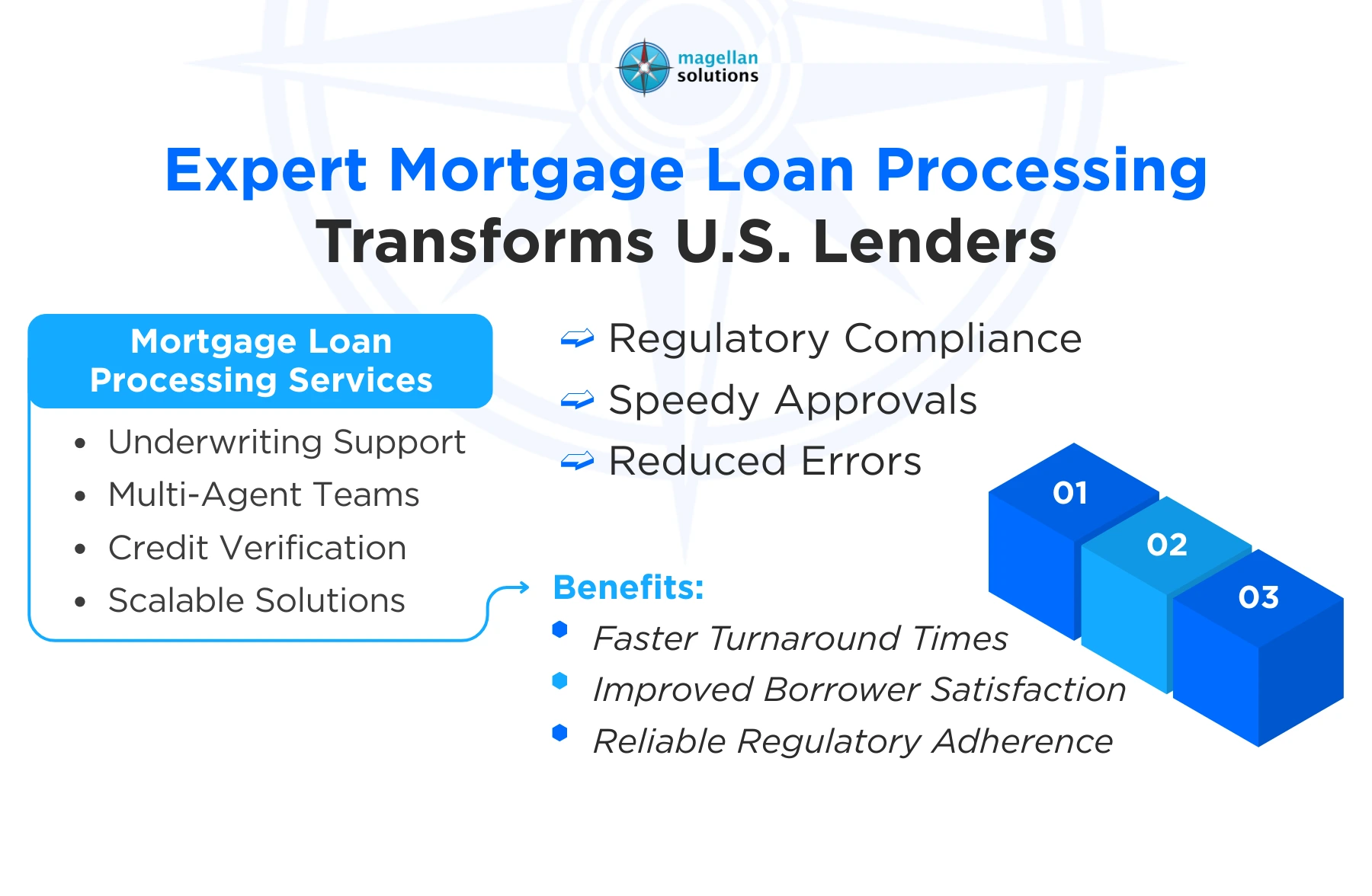

Expert mortgage loan processing is redefining how U.S. financial institutions handle mortgage applications. By using specialized mortgage loan processing services, lenders speed up approvals, ensure every detail is accurate, and stay compliant with regulations. In today’s fast-moving lending market, multi-agent, multi-FTE hubs provide the muscle institutions need to manage high loan volumes efficiently and reliably.

Why Mortgage Loan Processing Services Are Vital for U.S. Lenders

The mortgage landscape is competitive, and every day counts when processing applications. Mortgage loan processing services give banks and lenders a structured, reliable workflow to manage documentation, verification, and approvals. Multi-agent teams divide tasks to keep each step moving without delays.

Lenders see immediate benefits:

-

Faster loan approvals

-

Fewer processing errors

-

Tight compliance with federal and state requirements

-

Higher borrower satisfaction

Institutions that adopt these services gain both speed and consistency, allowing them to scale operations without sacrificing accuracy.

How Expert Mortgage Loan Processing Teams Drive Efficiency

Expert mortgage loan processing teams break down the mortgage cycle into specialized stages. From reviewing documentation and verifying credit to coordinating appraisals and supporting underwriting, every task is handled by professionals focused on their area of expertise. Multi-agent hubs allow multiple applications to be processed simultaneously, cutting turnaround times dramatically.

Efficiency gains include:

-

Parallel Processing: Different team members work on separate tasks at the same time.

-

Accuracy: Dedicated specialists catch errors early, preventing delays.

-

Scalability: Multi-FTE teams easily absorb spikes in loan demand.

-

Regulatory Adherence: Teams trained in compliance keep applications on track.

This approach ensures lenders can approve loans faster while maintaining high standards and reducing bottlenecks.

Smooth Documentation and Verification with Mortgage Loan Processing Services

Handling documents is often the slowest part of mortgage lending, but mortgage loan processing services streamline the process. Multi-agent hubs review, verify, and organize every document, from income statements to title reports. Each file gets careful attention to prevent errors and delays.

Advantages include:

-

Fewer mistakes and resubmissions

-

Quicker document handling

-

Clear audit trails for compliance

-

Centralized management for multiple applications

With expert teams managing paperwork, lenders can concentrate on growth and customer relationships rather than chasing missing forms or correcting errors.

Multi-Agent Teams: The Engine Behind Modern Mortgage Processing

Modern mortgage lenders rely on multi-agent models to maximize efficiency. Mortgage loan processing service teams assign specific responsibilities, including:

-

Credit assessment and risk analysis

-

Verification of borrower details

-

Coordination with underwriters and appraisers

-

Regulatory compliance checks

Multi-agent hubs prevent bottlenecks and make sure every loan moves smoothly through the pipeline. Even during high-volume periods, these teams maintain consistent accuracy and speed.

Leveraging Technology to Enhance Mortgage Loan Processing Services

Expert mortgage loan processing is more powerful when combined with technology. Cloud platforms, automated verification, and secure document management let teams work faster and smarter.

Benefits of tech integration include:

-

Real-time tracking of applications

-

Automatic alerts for missing documents

-

Stronger data security and privacy

-

Streamlined communication among agents and lenders

The mix of skilled multi-agent teams and cutting-edge technology creates a processing engine that maximizes throughput without sacrificing compliance or accuracy.

Reducing Costs and Mitigating Risk in Mortgage Loan Processing

Outsourcing mortgage loan processing services to multi-agent hubs cuts operational costs and reduces risk. Lenders avoid the overhead of training and retaining in-house staff for workloads that fluctuate throughout the year.

Advantages include:

-

Predictable costs through multi-FTE models

-

Fewer processing errors and financial penalties

-

Ability to scale quickly during busy seasons

-

Confidence in regulatory compliance

By trusting a professional multi-agent team, institutions optimize resources, minimize mistakes, and focus on strategic priorities.

Selecting the Right Mortgage Loan Processing Service Provider

Choosing a dependable mortgage loan processing service partner is critical. Look for providers that offer:

-

Multi-agent, multi-seated operations

-

Expertise in documentation and regulatory compliance

-

Seamless integration with existing systems

-

Flexible scaling for fluctuating loan volumes

Partnering with a professional provider ensures smooth operations, faster loan cycles, and consistent quality.

Conclusion: Magellan Solutions Powers Efficient Mortgage Loan Processing

For U.S. financial institutions aiming to fast-track lending operations, Magellan Solutions offers unmatched expert mortgage loan processing. Multi-agent, multi-FTE hubs deliver accurate, compliant, and scalable services that keep applications moving without delay. Lenders can improve approval times, enhance borrower satisfaction, and stay competitive by leveraging Magellan Solutions’ expertise.

Boost Your Lending Operations Today: Experience the efficiency and reliability of multi-agent mortgage loan processing services with Magellan Solutions. Visit magellan-solutions.com to see how professional teams can accelerate your mortgage approvals while maintaining precision and compliance.