Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

The goal of all industries is to modernize as part of a continuous improvement process. The impact of modernization in the insurance industry is very evident. For example, Insurtech combines “insurance” and “technology” so that it would be easier for insurance companies to do claims management. Many insurance companies have begun to leverage technologies such as artificial intelligence (AI) and big data to enhance their performance. Unfortunately, many Insurtech startups continue to struggle with claims management, often lacking the necessary expertise and resources. The good thing is that the business process outsourcing (BPO) industry is here to help Insurtech startups. There are many companies offering life insurance BPO services for Insurtech startups. Thus, Insurtech startups should not hesitate to utilize life insurance BPO services to enhance their claims management.

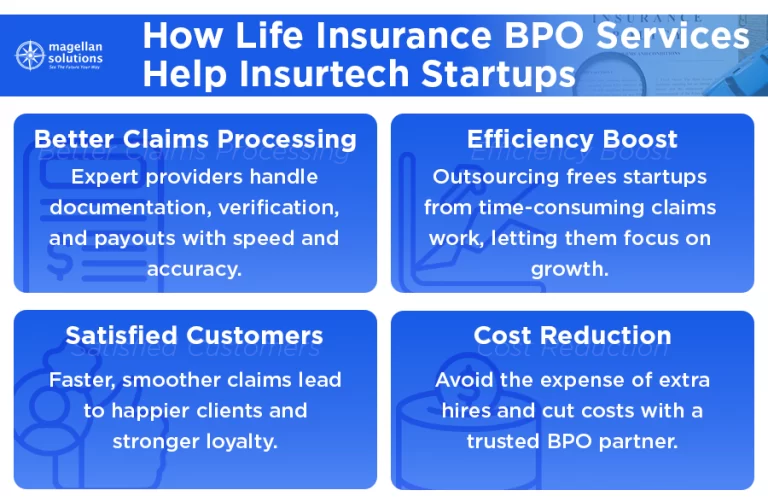

How Life Insurance BPO Services Help Insurtech Startups

- Better Claims Processing: Most life insurance BPO service providers are already experts in claims processing. These providers possess the knowledge, tools, and experience to simplify claims processing. Outsourcing can effectively handle documentation, verification, and payout monitoring tasks. Thus, Insurtech startups have nothing to worry about regarding claims processing anymore.

- Efficiency Boost: Understandably, many Insurtech startups struggle with claims management. Claims management can be very time-consuming for inexperienced Insurtech startups. Fortunately, many life insurance BPO service providers are ready to help Insurtech startups in claims management. Thus, Insurtech startups will finally become more efficient once they outsource claims management. Insurtech startups will have more time to focus on their core activities that drive profitability.

- Satisfied Customers: The reality is that Insurtech startups need to have loyal customers to sustain their operations. The best way for Insurtech startups to attract and retain loyal customers is to ensure consistent customer satisfaction. However, many Insurtech startups struggle with slow and ineffective claims management. These inefficiencies often result in dissatisfied customers. Thus, Insurtech startups must trust a reliable life insurance BPO service provider so they can have more satisfied customers.

- Cost Reduction: Insurtech startups have limited funds to hire more employees for claims management. Thus, the best option for Insurtech startups is just to hire a reliable life insurance BPO service provider. Pursuing this strategy can help Insurtech startups achieve cost reduction while also getting huge cost savings. These cost savings will be helpful for Insurtech startups in the long run.

Why Choose Magellan Solutions for Life Insurance BPO Services?

- Expertise: We understand the struggles of Insurtech startups in claims management due to a lack of knowledge. The good thing is that we have experts in life insurance with proven knowledge, skills, and experience. We regularly train our life insurance experts so that they will remain competent in helping customers.

- Flexibility: We recognize that Insurtech startups have diverse business needs beyond claims management. Fortunately, our life insurance experts can offer additional valuable services to Insurtech startups. For example, we can provide policy administration, underwriting tasks, and even billing support. Thus, Insurtech startups have nothing to worry about because we are flexible enough to support them.

- Strict Compliance: We ensure strict adherence to the regulations outlined in the Health Insurance Portability and Accountability Act (HIPAA). We respect all the rules and regulations as we provide the best life insurance BPO services possible. Thus, Insurtech startups can have peace of mind knowing that we strictly adhere to the law.

- Collaborative Approach: We are aware that Insurtech startups have many suggestions and requests regarding claims management. We are always willing to listen to Insurtech startups so that we can better understand their situation. We want to be on the same page with Insurtech startups regarding expectations and goals.

The Bottom Line

There are numerous life insurance BPO services available for Insurtech startups today. Insurtech startups should not hesitate to pursue the outsourcing route if they are struggling with claims management. However, Insurtech startups should also ensure that they choose the right outsourcing partner with proven experience to achieve the desired improvements.

Interested in Life Insurance BPO Services?

Magellan Solutions is a provider of inbound and outbound call center services, as well as business processing outsourcing, in the Philippines. The company has extensive experience in providing best-in-class outsourced solutions to small and medium-sized enterprises (SMEs) as well as large global enterprises. Combining unrivaled expertise and capabilities across industries and business functions, we bring fresh and new approaches to strategies and operational performance of business operations by delivering the right BPO and customer management solutions that span the entire customer lifecycle.

As a leading business process outsourcing provider of customer management solutions, we are committed to delivering an outstanding customer experience with every interaction. Visit Magellan-Solutions.com to learn more about our life insurance BPO services. You can also contact us now and receive a complimentary 60-minute consultation.