Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

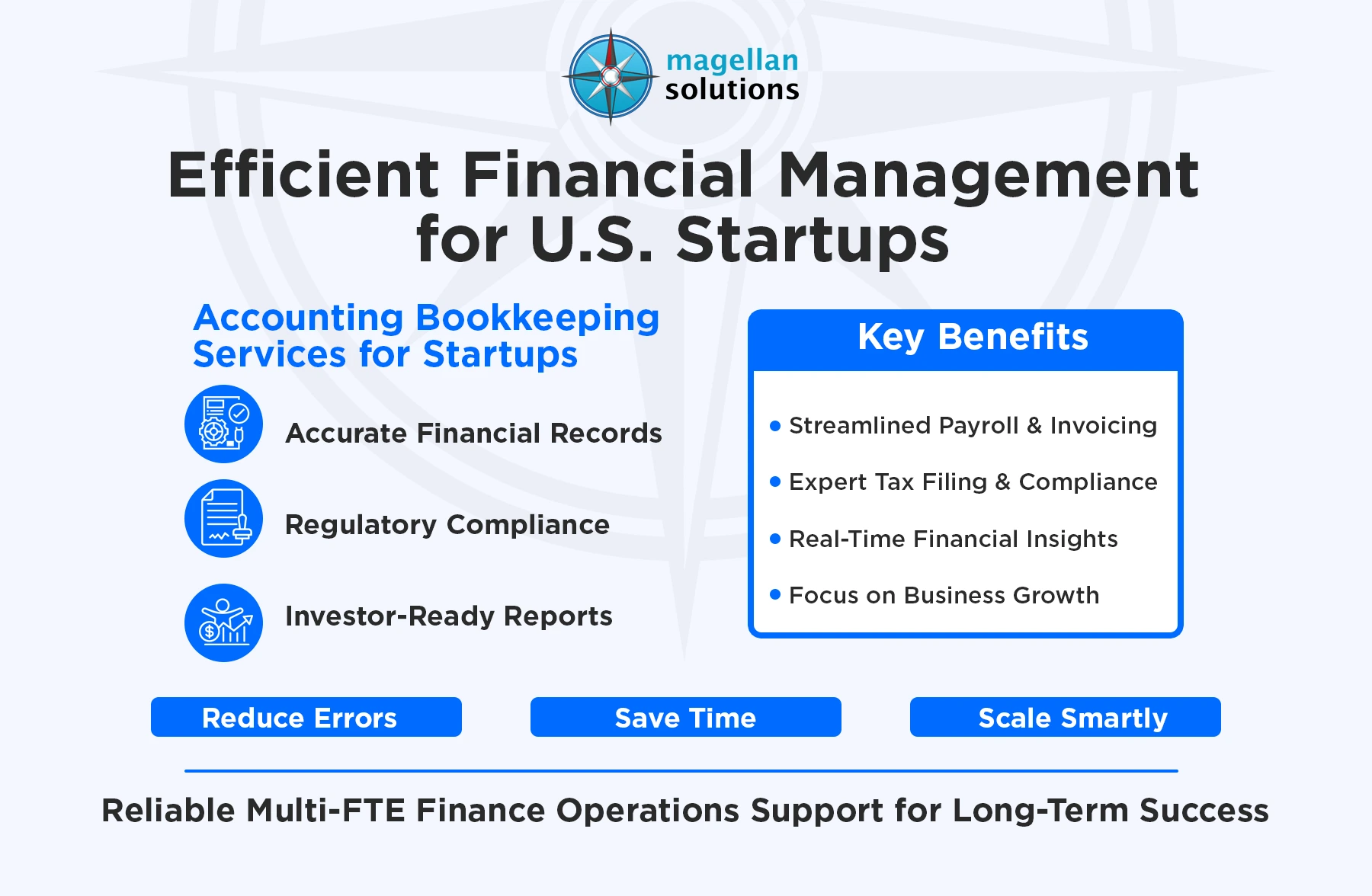

For U.S. startups, juggling growth, product development, and investor expectations often leaves financial management on the backburner. Yet keeping books accurate and up-to-date is crucial for both compliance and strategic decision-making. Finance operations support provides the structure and expertise startups need to manage day-to-day transactions, payroll, and tax obligations efficiently. By using professional accounting bookkeeping services for startups, founders can focus on growing their business while knowing that their financial records are accurate, organized, and audit-ready.

Why Accounting Bookkeeping Services for Startups Matter

Running a startup means handling countless moving parts, and finances are one of the most sensitive. Accounting bookkeeping services for startups simplify this complexity by giving founders a clear view of where every dollar comes from and where it goes. These services offer:

-

Accurate financial tracking: Every invoice, payment, and expense is recorded with precision.

-

Regulatory compliance: Tax filings and reporting deadlines are consistently met.

-

Investor-ready reports: Reliable statements help secure funding and maintain credibility.

-

Time efficiency: Founders can focus on scaling operations rather than reconciling ledgers.

When startups leverage these services, financial chaos transforms into clarity, empowering smarter decisions and smoother growth.

How Finance Operations Support Boosts Startup Efficiency

Finance operations support goes beyond bookkeeping. It’s a full-scale system of processes, multi-FTE teams, and tools that ensure financial management runs without hiccups. For startups, this means:

-

Automation that saves time

Cloud-based accounting platforms handle invoicing, payroll, and reconciliations automatically, cutting down errors and speeding up reporting cycles. -

Comprehensive reporting

Multi-agent teams generate detailed statements, dashboards, and analyses, giving founders and investors a real-time view of financial health. -

Scalable solutions

Startups grow fast, and outsourced finance operations expand with them. Multi-seated hubs can scale support without adding internal overhead.

Finance operations support transforms bookkeeping from a tedious chore into a strategic tool that drives operational efficiency and financial visibility.

Core Features of Accounting Bookkeeping Services for Startups

Professional accounting bookkeeping services for startups focus on the tasks that matter most for emerging businesses. Key features include:

1. General Ledger Management

Every transaction is tracked and reconciled daily, ensuring accurate records and real-time oversight. Multi-agent teams prevent errors and maintain consistent accounting practices.

2. Accounts Payable and Receivable

Managing incoming and outgoing payments keeps cash flow healthy. Bookkeeping teams ensure vendors are paid on time and invoices are collected promptly, preventing disruptions to operations.

3. Payroll Processing and Compliance

Payroll in the U.S. can be complex. Outsourced teams handle wage calculations, tax filings, and benefits tracking, ensuring employees are paid correctly and on time.

4. Tax Preparation and Filing

Up-to-date ledgers make tax season straightforward. Expert teams handle federal, state, and local filings, reducing risk of errors and penalties.

5. Financial Reporting and Analysis

Profit and loss statements, balance sheets, and cash flow reports provide actionable insights. Founders can identify trends, make informed decisions, and communicate financial health with confidence.

Benefits of Outsourcing Accounting Bookkeeping Services for Startups

Outsourcing accounting bookkeeping services for startups delivers benefits that in-house teams often can’t match:

-

Cost savings: Multi-agent teams eliminate the need for a full in-house finance department.

-

Specialized expertise: Startups gain access to professionals familiar with U.S. tax regulations, investor reporting, and growth-stage challenges.

-

Scalability: Services expand with your business, offering flexible coverage during high-growth periods.

-

Reduced risk: Expert teams minimize errors, ensuring accurate filings and financial statements.

-

More time to focus: Founders and core teams spend less time on bookkeeping and more on strategic initiatives.

By partnering with a provider like Magellan Solutions, startups access a multi-seated finance hub that ensures comprehensive coverage and consistency across all accounting operations.

How Technology Powers Accounting Bookkeeping Services for Startups

Modern accounting bookkeeping services for startups combine human expertise with technology. Cloud platforms make financial management faster, safer, and more transparent. Key advantages include:

-

Automated reconciliation: Transactions are matched automatically, minimizing manual mistakes.

-

Expense monitoring: Digital tracking ensures budgets are followed across teams.

-

Secure cloud access: Multi-user logins with role-based permissions protect sensitive data while enabling remote collaboration.

-

Insightful dashboards: Interactive analytics highlight trends and opportunities, supporting strategic decision-making.

When technology and multi-agent support work together, startups enjoy accurate records, compliance assurance, and actionable insights in real time.

Choosing the Right Accounting Bookkeeping Services for Startups

Selecting a provider for accounting bookkeeping services for startups requires careful evaluation. Look for:

-

Industry experience

The provider should understand startup dynamics, U.S. financial regulations, and tech-focused business models. -

Multi-FTE team capabilities

Multi-agent teams can handle large transaction volumes, provide continuous coverage, and deliver specialized attention across functions. -

Customizable services

Solutions should fit the startup’s size, growth stage, and reporting needs, from budgeting to payroll and investor reporting. -

Proven track record

Seek providers with case studies, client testimonials, and a history of successful startup support. -

Technology integration

The provider should use robust accounting platforms that integrate seamlessly with your existing business systems.

Choosing the right partner ensures financial management is accurate, compliant, and scalable, freeing founders to focus on growth.

Common Challenges Solved by Accounting Bookkeeping Services for Startups

U.S. startups face hurdles like cash flow issues, tax compliance, and investor reporting. Accounting bookkeeping services for startups tackle these challenges head-on:

-

Cash flow visibility: Accurate tracking of payables and receivables prevents liquidity crises.

-

Tax compliance: Expert teams manage filings across federal, state, and local requirements.

-

Real-time insights: Multi-agent reporting systems provide dashboards that support quick, informed decisions.

-

Investor confidence: Reliable, well-prepared statements strengthen credibility with stakeholders.

By outsourcing these tasks, startups transform financial complexity into structured, actionable processes that drive stability and growth.

Why Magellan Solutions Stands Out for Accounting Bookkeeping Services for Startups

Magellan Solutions delivers accounting bookkeeping services for startups through a multi-agent, multi-seated hub model. This approach ensures startups get:

-

Complete financial management, from daily ledger updates to reporting and tax filing

-

Compliance with federal, state, and local regulations

-

Real-time dashboards and actionable insights for better decision-making

-

Scalable support that grows with the startup

Working with a multi-FTE team ensures consistency, coverage, and expertise, making Magellan Solutions a reliable partner for U.S. startups looking to streamline finances and boost operational efficiency.

Conclusion: Take Control of Startup Finances Today

U.S. startups need precise, scalable, and reliable financial management to thrive. Accounting bookkeeping services for startups provide the tools, expertise, and multi-agent support necessary to maintain accurate records, ensure compliance, and inform strategic decisions. Startups can operate with confidence, knowing their finances are in expert hands, and founders can devote more energy to growth and innovation.

Partner with Magellan Solutions and Streamline Your Startup’s Finances

Magellan Solutions offers multi-FTE finance operations support designed for U.S. startups. With accurate reporting, regulatory compliance, and scalable solutions, your startup can focus on growth while leaving bookkeeping to the experts. Visit magellan-solutions.com to explore our tailored services and start simplifying your financial management today.