Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

Retailers operate in a market where every transaction counts. Customers expect payments to go through instantly, securely, and without confusion, whether they are buying online, in-store, or across borders. For growing brands, credit card processing services small business retailers rely on serve as the backbone of daily revenue operations. These services support consistent cash flow, protect customer data, and keep global transactions running smoothly.

As retail becomes more international and digital-first, payment complexity rises fast. Many companies choose to outsource merchant processing services to maintain performance while scaling efficiently. Outsourced teams handle volume, compliance, and operational demands with a level of focus that internal teams often struggle to sustain.

This article explores how modern payment processing supports global retail, why outsourcing delivers measurable advantages, and what retailers should look for when selecting a long-term processing partner.

How Credit Card Processing Services Small Business Retailers Use Power Daily Transactions

Credit card processing services small business retailers depend on manage the full transaction journey. These services authorize payments, transmit encrypted data, settle funds, and handle downstream processes like refunds and reconciliation.

For retailers selling in multiple regions, each transaction carries added layers of currency handling, card network rules, and local regulations. A dependable processing system ensures payments clear accurately and on time, regardless of where the customer shops.

Key processing components include:

-

Secure payment gateways for ecommerce and point-of-sale systems

-

Real-time authorization across global card networks

-

Encrypted data transmission that meets compliance standards

-

Automated settlement and reporting workflows

When these systems perform well, retailers gain stability and customers experience a smooth checkout every time.

Why Retailers Choose to Outsource Merchant Processing Services

Payment operations grow more demanding as transaction volume increases. Retailers that outsource merchant processing services gain access to specialized teams trained to manage these demands at scale.

Outsourcing shifts the responsibility of monitoring transactions, resolving exceptions, and maintaining uptime to dedicated professionals. This structure allows internal teams to focus on merchandising, marketing, and customer engagement.

Business advantages include:

-

Lower operational costs compared to building internal processing teams

-

Faster issue resolution during peak transaction periods

-

Continuous coverage across time zones and business hours

-

Access to established workflows and quality controls

Retailers benefit from a service model designed to handle complexity without disrupting daily operations.

Credit Card Processing Services Small Business Retailers Use to Support Omnichannel Growth

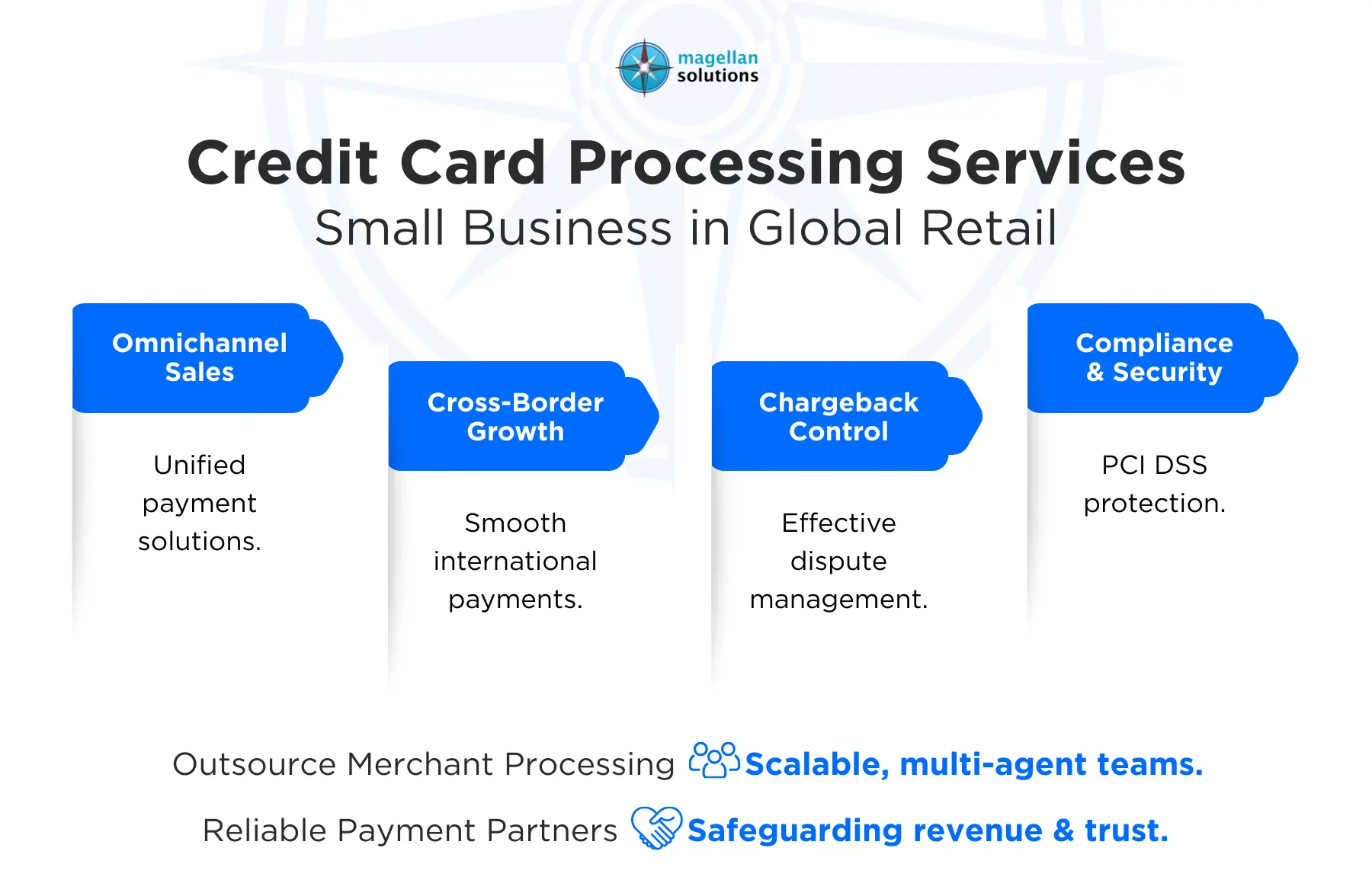

Retail customers move freely between physical stores, websites, mobile apps, and online marketplaces. Credit card processing services small business retailers use must support every channel without breaking data continuity.

Unified processing platforms consolidate transactions into a single system. This approach improves visibility and simplifies reporting across channels.

Omnichannel payment capabilities include:

-

Centralized transaction tracking across all sales platforms

-

Consistent payment experiences regardless of channel

-

Real-time synchronization between online and offline systems

-

Streamlined refund and return processing

Retailers that unify payment operations reduce friction while improving customer trust and operational clarity.

Payment Security Standards That Protect Revenue and Brand Trust

Security plays a central role in payment processing. Retailers handle sensitive cardholder data daily, and strong safeguards protect both revenue and reputation.

Professional credit card processing services small business retailers rely on maintain strict compliance with PCI DSS standards. These services apply layered security controls that limit exposure to fraud and data breaches.

Common security measures include:

-

End-to-end encryption for all payment data

-

Tokenization to minimize sensitive data storage

-

Continuous transaction monitoring for suspicious activity

-

Routine compliance checks and system audits

Outsourced processing teams actively watch transaction flows and respond quickly when risks appear.

Managing Chargebacks Through Outsourced Merchant Processing Services

Chargebacks drain revenue and consume internal resources. Retailers that outsource merchant processing services gain structured dispute management that improves outcomes and reduces administrative strain.

Dedicated teams handle evidence collection, issuer communication, and dispute timelines. This approach improves response speed and consistency.

Effective chargeback management includes:

-

Centralized tracking of dispute activity

-

Timely submission of supporting documentation

-

Analysis of dispute trends to prevent repeat issues

-

Customer communication support during resolution

Retailers maintain stronger standing with card networks while protecting margins.

Credit Card Processing Services Small Business Retailers Use for Cross-Border Sales

International retail brings opportunity along with complexity. Credit card processing services small business retailers use must support regional payment preferences, currency conversion, and compliance requirements.

Global processing capabilities typically include:

-

Multi-currency authorization and settlement

-

Support for regional card brands and payment methods

-

Market-specific fraud rules and risk controls

-

Compliance alignment with local regulations

Retailers expanding into new regions rely on these services to deliver consistent checkout experiences worldwide.

Scaling Payment Operations With Outsourced Processing Teams

Retail demand fluctuates with promotions, holidays, and market expansion. Scaling payment operations internally often leads to staffing challenges and performance gaps.

Retailers that outsource merchant processing services rely on multi-agent, multi-seat teams designed to scale with transaction volume. These teams follow established workflows and performance benchmarks.

Scalable outsourcing provides:

-

Flexible staffing aligned with real-time demand

-

Continuous monitoring during high-volume periods

-

Standardized procedures that maintain accuracy

-

Ongoing performance reporting and optimization

This structure supports growth without sacrificing reliability.

Data Visibility Through Credit Card Processing Services Small Business Retailers Value

Payment data tells a powerful story about customer behavior and revenue performance. Credit card processing services small business retailers value deliver detailed insights that guide decision-making.

Advanced reporting includes:

-

Transaction volume by channel and region

-

Authorization and decline trend analysis

-

Chargeback frequency and root causes

-

Settlement timelines and reconciliation accuracy

Retail leaders use these insights to improve approval rates, refine pricing, and enhance checkout experiences.

Technology Integration That Keeps Retail Systems Connected

Retail operations depend on interconnected systems. Payment processing must integrate smoothly with ecommerce platforms, inventory tools, accounting software, and CRM systems.

Modern credit card processing services small business retailers choose support API-based integrations that maintain data accuracy across platforms.

Integration benefits include:

-

Automated accounting reconciliation

-

Real-time inventory updates tied to completed payments

-

Unified customer transaction histories

-

Reduced manual data entry and errors

Technology alignment keeps operations efficient and data reliable.

How to Select the Right Outsourced Merchant Processing Partner

Choosing a processing partner shapes long-term operational performance. Retailers should evaluate service providers based on experience, scalability, and service structure.

Key considerations include:

-

Proven support for global retail environments

-

Availability of dedicated multi-agent service teams

-

Strong compliance and security frameworks

-

Transparent performance metrics and reporting

A reliable partner operates as a seamless extension of internal operations.

Strengthen Global Retail Payments With Magellan Solutions

Scale Transactions Confidently With a Dedicated Payment Support Team

Retailers seeking dependable credit card processing services small business operations benefit from working with a partner built for scale. Magellan Solutions delivers outsourced payment processing support through a structured, multi-agent, multi-seated service model designed for global retail demands.

Dedicated teams manage transaction workflows, compliance monitoring, chargeback support, and payment operations with precision and consistency. This approach allows retailers to grow across markets while maintaining control and reliability.

Outsource merchant processing services to a partner that understands retail complexity and delivers operational stability through team-based support.

Connect with Magellan-Solutions.com today to explore how a dedicated payment processing support team can help your retail business scale with confidence.