Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

People and businesses seeking financial assistance typically turn to banks for loans. However, there are instances in which banks reject loan applications from individuals and businesses for various reasons. Fortunately, private lenders and brokers exist to help individuals and businesses obtain the financial assistance they need through mortgage servicing support. In the U.S., RCN Capital, CV3 Financial Services, and American Community Lending are examples of private lenders and brokers. However, many U.S. private lenders and brokers struggle to manage borrower accounts, payments, and compliance. The good thing is that mortgage loan processing services are now available to help U.S. private lenders and brokers. Thus, U.S. private lenders and brokers should leverage mortgage servicing support to improve their loan management process.

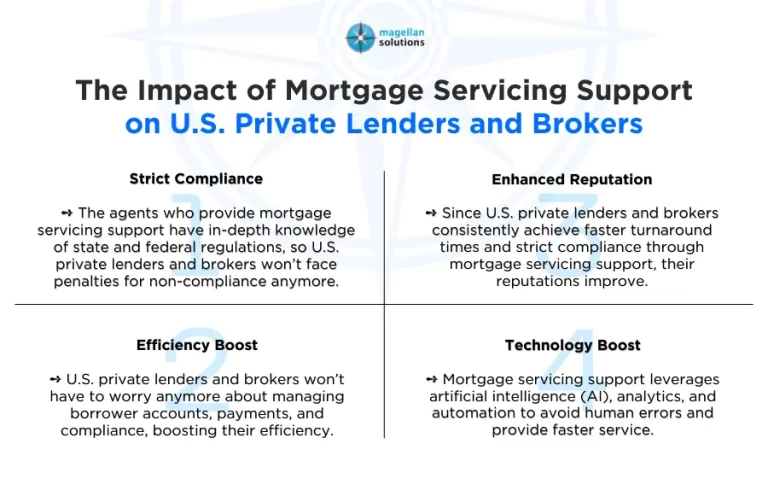

The Impact of Mortgage Servicing Support on U.S. Private Lenders and Brokers

- Strict Compliance: The agents who provide mortgage servicing support have in-depth knowledge of state and federal regulations. Thus, U.S. private lenders and brokers won’t face penalties for non-compliance. The credibility of U.S. private lenders and brokers grows stronger through strict compliance with state and federal regulations.

- Efficiency Boost: When U.S. private lenders and brokers rely on mortgage servicing support, they inevitably become more efficient. U.S. private lenders and brokers won’t have to worry about managing borrower accounts, payments, and compliance. Thus, U.S. private lenders and brokers will have more time to focus on their core activities and relationship management.

- Enhanced Reputation: Since U.S. private lenders and brokers consistently achieve faster turnaround times and strict compliance through mortgage servicing support, their reputations improve. Thus, it becomes easier for U.S. private lenders and brokers to attract more customers as their reputations improve.

- Technology Boost: Mortgage servicing support leverages artificial intelligence (AI), analytics, and automation. Thus, U.S. private lenders and brokers won’t have to worry about human errors anymore. U.S. private lenders and brokers can expect faster service to serve their customers better.

Why Choose Magellan Solutions for Mortgage Servicing Support?

- Expertise: We have excellent mortgage servicing support agents with impeccable knowledge, skills, and experience. We ensure our agents receive regular, comprehensive training to support their continuous improvement. Thus, U.S. private lenders and brokers should hire us as their outsourcing partner given our expertise.

- Cost Reduction: We want to help U.S. private lenders and brokers save significant money by eliminating the need to hire and train mortgage servicing support agents. Instead, a better option is for U.S. private lenders and brokers to hire us as their outsourcing partner to reduce costs. U.S. private lenders and brokers will appreciate significant cost savings, which they can use to pursue investment opportunities.

- Scalability: We know that U.S. private lenders and brokers experience periods of unstable loan volume. The good news is that our mortgage servicing is scalable enough to meet the needs of U.S. private lenders and brokers. Thus, U.S. private lenders and brokers can rest assured that we will find ways to help them.

- Collaborative Approach: We understand that U.S. private lenders and brokers may have questions and concerns about our mortgage servicing. We are ready to collaborate with U.S. private lenders and brokers to find out how we can help. We are confident that we can meet the expectations of U.S. private lenders and brokers through collaboration.

The Bottom Line

Mortgage servicing support for U.S. private lenders & brokers is excellent. U.S. private lenders and brokers should recognize the significant benefits of outsourcing. However, U.S. private lenders and brokers must choose a reliable outsourcing partner to maximize the benefits of outsourcing. U.S. private lenders and brokers must choose an outsourcing partner with strong credentials to achieve the best results.

Interested in Mortgage Servicing Support?

Magellan Solutions is a provider of inbound and outbound call center services, as well as business processing outsourcing, in the Philippines. The company has extensive experience providing best-in-class outsourced solutions to small and medium-sized enterprises (SMEs) and large global enterprises. Combining unrivaled expertise and capabilities across industries and business functions, we bring fresh approaches to strategy and operational performance by delivering the right BPO and customer management solutions that span the entire customer lifecycle.

As a leading business process outsourcing provider of customer management solutions, we are committed to delivering an outstanding customer experience with every interaction. Visit Magellan-Solutions.com to learn more about our mortgage servicing support. You can also contact us now and receive a complimentary 60-minute consultation.