Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

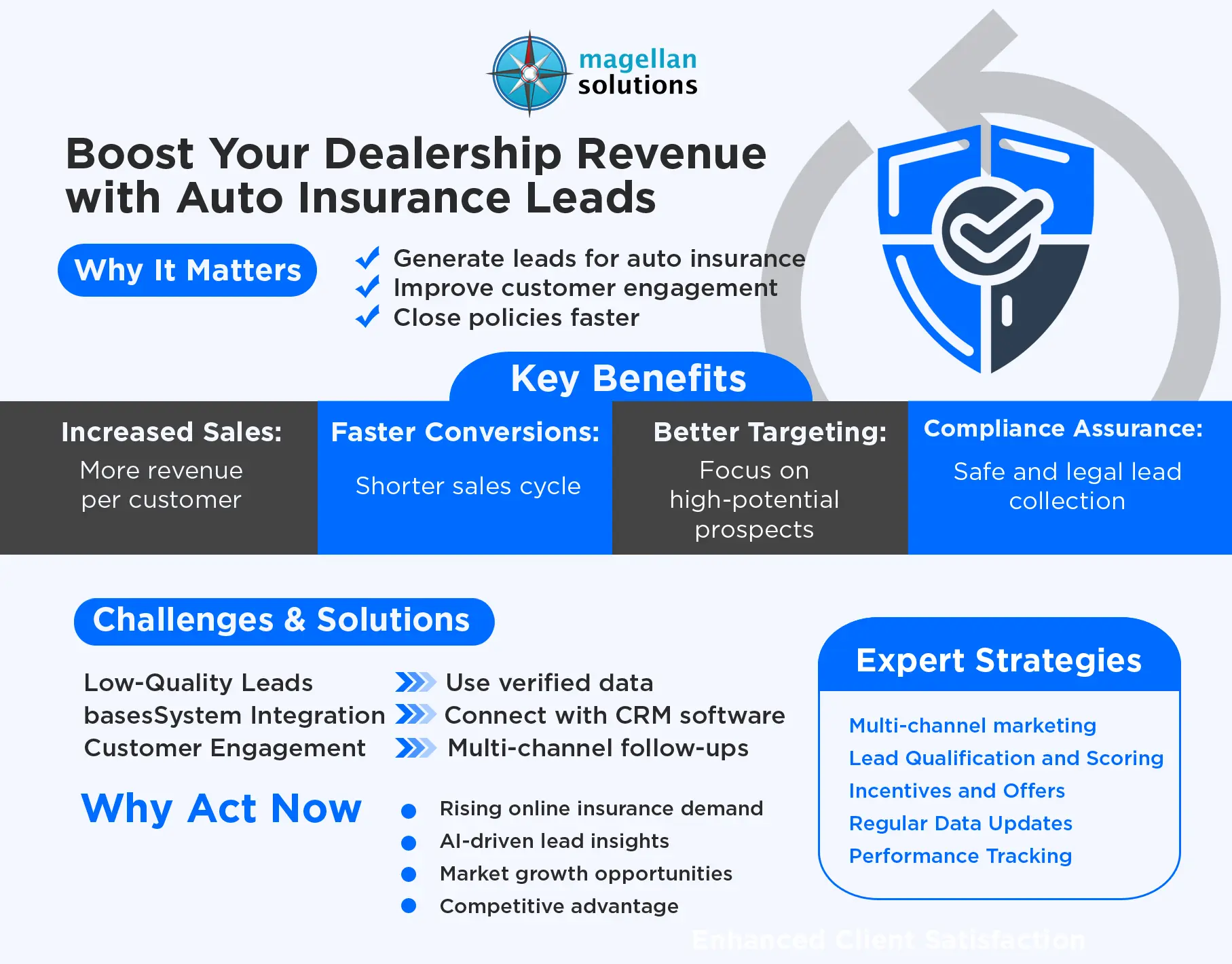

U.S. dealerships are increasingly focused on generate leads for auto insurance to stay competitive in today’s fast-paced market. Customers expect a seamless experience when buying a vehicle, which often includes assistance in obtaining auto insurance. By connecting with clients who need insurance coverage, dealerships can not only boost revenue but also provide a more comprehensive service.

This article explores how auto insurance lead generation can help dealerships increase sales, improve customer satisfaction, and streamline insurance processes. It will cover what lead generation is, its benefits, common challenges, and actionable strategies. Whether you operate a small regional dealership or a large national chain, understanding the nuances of effective lead generation is essential for growth and long-term success.

What is Auto Insurance Lead Generation

Auto insurance lead generation refers to the process of identifying, attracting, and nurturing potential customers who are interested in purchasing auto insurance. The process typically includes:

-

Collecting contact information from interested prospects through forms, phone calls, or online inquiries

-

Qualifying leads based on insurance needs, vehicle type, and coverage preferences

-

Using digital marketing, analytics, and targeted outreach to reach the most relevant prospects

Lead generation has become a cornerstone for dealerships because it allows them to proactively connect with customers rather than relying on walk-ins or traditional advertising. In addition, dealerships that integrate insurance lead generation into their sales process provide a more convenient, all-in-one solution, which customers increasingly expect.

With the rise of online research and instant quote tools, customers are less likely to rely solely on dealership staff for insurance information. Implementing a structured lead generation strategy ensures that dealerships can capture these potential customers before competitors do.

Key Benefits of Auto Insurance Lead Generation

Investing in auto insurance lead generation offers several tangible benefits for U.S. dealerships:

1. Increased Sales Opportunities

By presenting auto insurance alongside vehicle sales, dealerships create additional revenue streams. For example, offering bundled insurance packages can encourage customers to complete both purchases at the same time, increasing the average sale per customer.

2. Improved Customer Retention

Customers are more likely to return to a dealership that provides convenience and trust. Offering insurance services at the point of sale helps build long-term relationships, leading to repeat purchases or referrals.

3. Better Targeting and Efficiency

Data-driven lead generation allows dealerships to focus on prospects who are most likely to purchase insurance. This reduces wasted marketing spend and ensures that sales teams engage with high-value leads.

4. Faster Conversions

Pre-qualified leads shorten the sales cycle because the customer has already shown interest in insurance services. Dealership teams can follow up immediately, increasing the likelihood of closing policies.

5. Compliance and Accuracy

High-quality lead generation platforms ensure customer information is collected in compliance with U.S. insurance regulations. This reduces legal risk while providing reliable and accurate leads.

6. Competitive Advantage

Dealerships leveraging advanced lead generation strategies gain a significant edge over competitors by offering a seamless, integrated buying experience that combines vehicle sales with insurance solutions.

7. Insightful Customer Analytics

Lead generation platforms often include analytics features that allow dealerships to understand customer behavior, preferences, and buying patterns. These insights can be used to improve marketing strategies and sales tactics over time.

Common Challenges and Solutions

Even with its clear benefits, dealerships face several challenges in implementing auto insurance lead generation. Here’s how to address them:

Challenge 1: Low-Quality Leads

Solution: Work with reputable lead generation providers who specialize in auto insurance. Using verified, opt-in databases ensures the leads are accurate, actionable, and relevant. Dealerships can also implement lead scoring to prioritize high-value prospects.

Challenge 2: Integration with Existing Systems

Solution: Choose platforms that integrate seamlessly with dealership CRM systems. Smooth integration ensures leads are properly tracked, assigned to the right sales reps, and followed up promptly.

Challenge 3: Maintaining Customer Engagement

Solution: Implement multi-channel communication strategies such as emails, phone calls, SMS, and even retargeting ads. Consistent follow-up helps nurture leads, maintain interest, and increase conversion rates.

Challenge 4: Regulatory Compliance

Solution: Partner with providers familiar with federal and state insurance regulations. Proper training and automated compliance checks can help dealerships avoid penalties while maintaining high-quality lead data.

Challenge 5: Limited Staff or Resources

Solution: Outsourcing parts of the lead generation process to specialized providers can reduce the workload on internal teams, allowing them to focus on closing deals and enhancing customer service.

Best Practices for Successful Lead Generation

To achieve maximum success, dealerships should adopt proven strategies:

-

Leverage Multi-Channel Marketing: Use a combination of social media, search engine ads, and email campaigns to reach potential customers wherever they spend their time online.

-

Qualify Leads Effectively: Implement lead scoring systems that rank prospects based on behavior, demographics, and readiness to purchase. Focus efforts on high-value leads.

-

Offer Incentives: Encourage prospects to provide contact information by offering free consultations, premium discounts, or limited-time promotions.

-

Maintain Accurate and Updated Data: Regularly cleanse databases to remove duplicates, outdated contacts, and unresponsive leads. Accurate data improves follow-up efficiency and conversion rates.

-

Monitor Performance and Adjust: Track key metrics such as lead quality, conversion rates, and return on investment. Use insights to adjust strategies and continually improve outcomes.

-

Train Sales Teams on Lead Handling: Even the best leads can be wasted if not handled properly. Provide training on timely follow-ups, effective communication, and tailored insurance recommendations.

Why Now is the Best Time to Invest

The U.S. auto insurance industry is evolving rapidly, and dealerships that adopt auto insurance lead generation now can capitalize on several trends:

-

Digital Adoption: Consumers increasingly research vehicles and insurance online before visiting a dealership. Lead generation allows dealerships to capture these online prospects.

-

AI and Analytics: Predictive analytics and AI-driven scoring models allow dealerships to identify high-potential leads with precision.

-

Bundled Services Expectation: Customers expect a seamless buying experience that includes both vehicles and insurance. Dealerships offering this convenience can stand out from competitors.

-

Market Growth Opportunities: As auto insurance needs continue to rise with more vehicles on the road, dealerships that invest in lead generation now will secure a long-term advantage.

Acting now positions dealerships to build a steady pipeline of high-quality leads, strengthen customer loyalty, and improve overall profitability.

Conclusion

Auto insurance lead generation is no longer optional for U.S. dealerships. It is a critical strategy to drive sales, retain customers, and maintain a competitive edge. Implementing effective lead generation practices allows dealerships to connect with prospects quickly, provide a seamless buying experience, and enhance business growth.

Magellan Solutions is a trusted partner for dealerships seeking high-quality, verified auto insurance leads. With expertise in compliance, accuracy, and performance tracking, Magellan Solutions helps dealerships achieve measurable results. To learn more and receive a free consultation, visit www.magellan-solutions.com