Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

Across the Asia-Pacific region, financial institutions are facing growing competition for investor attention, capital, and trust. As digital adoption accelerates, lead generation for financial operations has become a core growth strategy for banks, fintech firms, wealth managers, and investment companies. Rather than relying on cold outreach or broad advertising, firms now use structured, data driven approaches to attract and engage qualified prospects.

This article explores how lead generation financial services support investor targeting, relationship building, and scalable growth in the APAC financial services sector. You will learn what financial lead generation is, why it matters, its key benefits, common challenges, best practices, and why now is the right time to invest in these strategies.

What is Lead Generation Financial Services

Lead generation financial services refers to the process of identifying, attracting, qualifying, and nurturing potential investors or clients for financial products and services. These services combine digital marketing, data analytics, compliance driven outreach, and sales alignment to deliver prospects who are more likely to convert.

In financial services, lead generation often includes targeted content marketing, paid media campaigns, landing pages, investor profiling, CRM integration, and automated follow up. For Asia-Pacific firms, this approach is essential due to diverse markets, varying regulations, and rapidly evolving investor expectations. By using structured lead generation, financial organizations gain better visibility into investor intent and can engage prospects at the right time with relevant offerings.

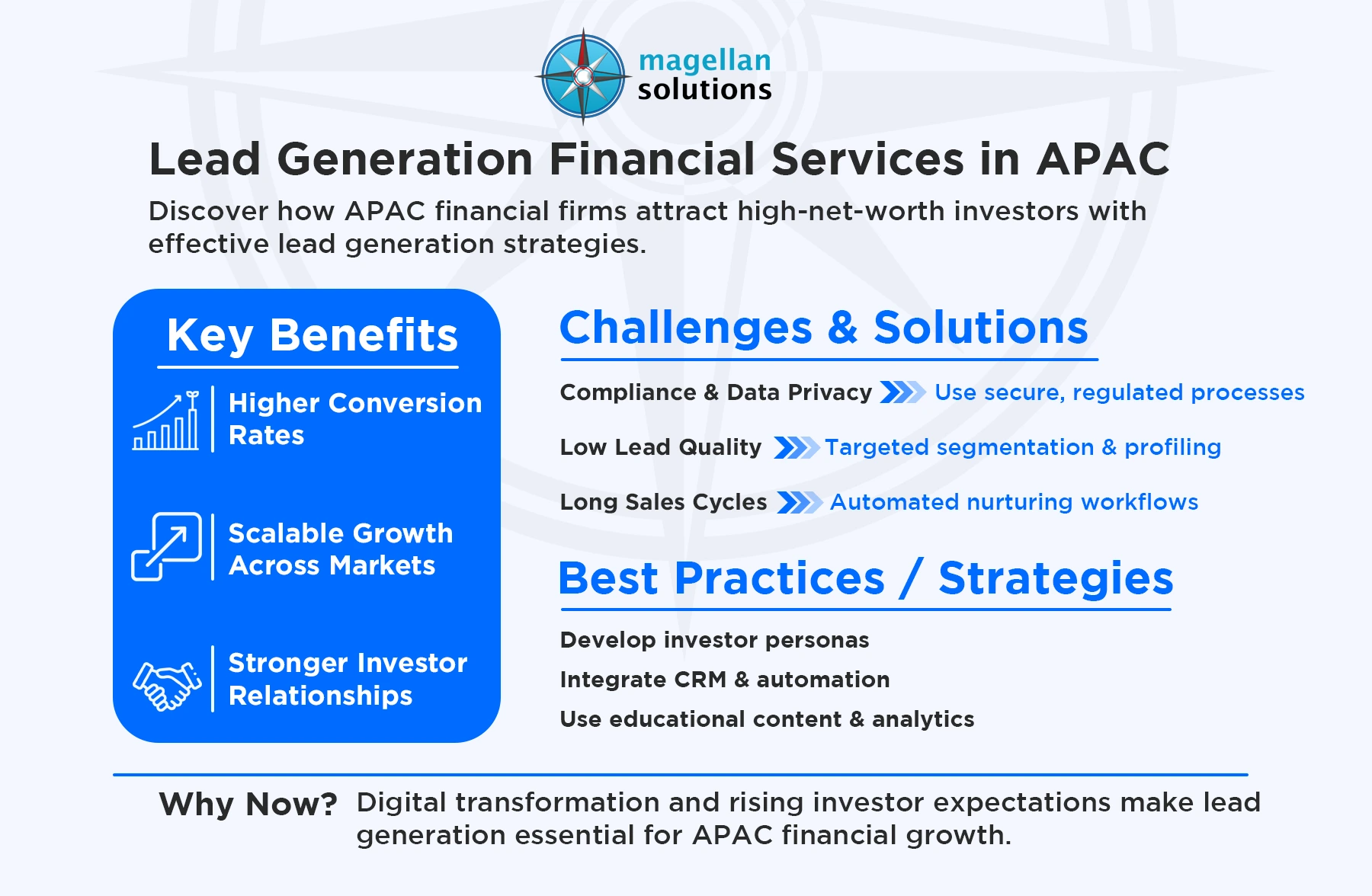

Key Benefits of Lead Generation Financial Services

Implementing a strong lead generation strategy delivers measurable value for financial institutions across the region.

Higher Quality Investor Leads

Targeted campaigns focus on demographics, income levels, and investment behavior. This results in prospects who are more aligned with specific financial products, improving conversion rates and reducing wasted outreach.

Improved Cost Efficiency

Digital lead generation reduces reliance on expensive traditional channels. Financial firms can optimize campaigns in real time, lowering cost per lead while maintaining consistent volume.

Stronger Client Relationships

Personalized messaging and timely follow ups help build trust early in the investor journey. This is especially important for wealth management and investment services where credibility drives long term value.

Scalable Growth Across APAC Markets

Lead generation systems can be replicated and localized across multiple Asia-Pacific countries. Firms can expand without proportionally increasing internal sales or marketing resources.

Better Data and Performance Tracking

Advanced analytics provide insights into campaign performance, investor behavior, and ROI. Financial leaders can make informed decisions based on measurable outcomes rather than assumptions.

Common Challenges and Solutions

Despite its advantages, financial lead generation comes with specific challenges, especially in regulated markets.

Regulatory Compliance and Data Privacy

Financial firms must comply with strict regulations on data usage and investor communication.

Solution: Work with lead generation providers that understand regional compliance standards and implement secure data handling practices.

Low Lead Quality from Broad Campaigns

Generic messaging often attracts unqualified prospects.

Solution: Use segmentation, investor profiling, and intent based targeting to refine audience selection.

Long Sales Cycles

Investment decisions take time and require multiple touchpoints.

Solution: Implement automated nurturing workflows that deliver educational content and build confidence over time.

Limited Internal Resources

Many firms lack the manpower to manage campaigns and follow ups.

Solution: Outsource lead generation operations to specialized service providers with financial services expertise.

Best Practices or Strategies

To succeed with lead generation financial services, Asia-Pacific firms should focus on the following best practices.

Develop clear investor personas based on financial goals, risk appetite, and market maturity. Align messaging to each persona to improve engagement.

Invest in high quality content such as market insights, investment guides, and educational webinars. Content builds authority and attracts informed prospects.

Integrate lead generation tools with CRM and sales platforms. This ensures seamless handoff between marketing and sales teams.

Leverage marketing automation for lead scoring and nurturing. Automation helps prioritize high intent leads and improves response times.

Continuously test and optimize campaigns using performance data. Small adjustments in targeting or messaging can significantly improve results.

Why Now is the Best Time to Invest in Lead Generation Financial Services

The Asia-Pacific financial market is undergoing rapid digital transformation. Retail investing is rising, fintech adoption is accelerating, and high net worth individuals are seeking more personalized financial experiences. At the same time, competition is intensifying as global and regional players target the same investor segments.

These trends create a strong case for investing in structured lead generation now. Firms that act early gain first mover advantages in data collection, brand recognition, and investor trust. With increasing reliance on digital channels, lead generation is no longer optional but a strategic necessity for sustainable growth in APAC financial services.

Conclusion

Lead generation financial services play a critical role in helping Asia-Pacific financial institutions attract, engage, and convert qualified investors. By focusing on data driven targeting, compliance, and personalized engagement, firms can improve efficiency and build stronger client relationships.

Interested in lead generation financial services?

Magellan Solutions is a trusted provider of outsourced sales and marketing solutions for the financial services industry. Operating in the Asia-Pacific region, Magellan Solutions delivers compliant, scalable lead generation services that help financial firms connect with the right investors and drive long term growth.

Visit www.magellansolutions.com and request a free consultation to learn how their expertise can support your lead generation strategy.