Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

It is difficult to imagine what society would look like without e-commerce. There are just too many benefits that e-commerce provides for businesses and consumers. Consumers can now shop and buy anything they want, anytime, through e-commerce. Businesses become more profitable because e-commerce provides greater shopping convenience for their customers. In the Asia-Pacific (APAC) region, Shopee, Lazada, and Alibaba are among the most successful e-commerce companies. However, many APAC e-commerce companies are struggling with credit card payment processing, resulting in lost profits. Fortunately, credit card processing services are now available to help APAC e-commerce companies. Thus, APAC e-commerce companies should leverage retail credit card processing to sustain their profitability. Retail credit card processing will help APAC e-commerce companies to thrive.

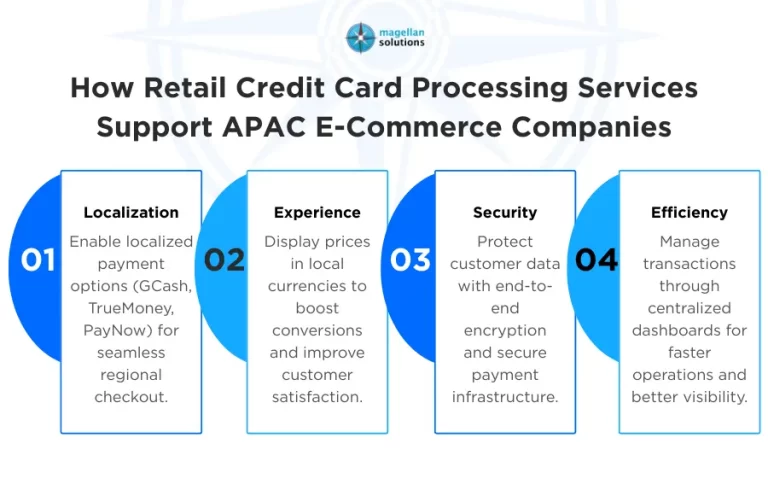

How Retail Credit Card Processing Services Support APAC E-Commerce Companies

- Localized Payment: Retail credit card processing services rely on localized payment options to enhance consumer convenience. For example, there is GCash in the Philippines, TrueMoney in Thailand, and PayNow in Singapore. Thus, APAC e-commerce companies will appreciate having localized payment options that their customers can choose from.

- Improved Customer Experience: Automated currency conversion in retail credit card processing services enhances the customer experience. APAC e-commerce companies can display prices in local currencies, which significantly improves sales.

- Data Protection: APAC e-commerce companies must be wary of numerous cybersecurity threats. Fortunately, retail credit card processing services already use end-to-end encryption to protect confidential customer data. Thus, APAC e-commerce companies won’t have to worry about data leakage.

- Efficiency Boost: When APAC e-commerce companies use retail credit card processing services, they gain access to centralized dashboards for greater efficiency. Thus, it will now be easier for APAC e-commerce companies to monitor transactions across multiple channels and countries.

Why Choose Magellan Solutions for Credit Card Processing Services?

- Expertise: Our agents provide the best retail credit card processing services, which APAC e-commerce companies will surely appreciate. Our agents undergo ongoing training to support continuous improvement. Thus, APAC e-commerce companies can confidently hire us as their outsourcing partner, given our expertise.

- Cost Reduction: We help APAC e-commerce companies reduce costs by eliminating the need to hire and train additional personnel. Instead, APAC e-commerce companies can rely on our retail credit card processing services to achieve significant cost reductions. APAC e-commerce companies will appreciate the significant cost savings they can use for emergencies.

- Robust Security: We take security very seriously. We understand that strong security helps establish a BPO company’s credibility. We are proud to hold ISO 27001, PCI DSS, and HIPAA certifications, demonstrating our commitment to maintaining high security standards. APAC e-commerce companies can rest assured that their data is secure with us and that there is no data leakage.

- Collaborative Approach: We understand that APAC e-commerce companies may have concerns about our retail credit card processing services. We are ready to collaborate with APAC e-commerce companies to know how we can help. We are confident that we can make a difference for APAC e-commerce companies through collaboration.

The Bottom Line

Retail credit card processing for the APAC e-commerce industry is effective enough. There is no reason APAC e-commerce companies won’t pursue outsourcing, given its benefits. However, APAC e-commerce companies must choose the right outsourcing partner to maximize the benefits of outsourcing. APAC e-commerce companies should choose a proven, accomplished outsourcing partner to achieve consistent results.

Interested in Credit Card Processing Services?

Magellan Solutions is a provider of inbound and outbound call center services, as well as business processing outsourcing, in the Philippines. The company has extensive experience providing best-in-class outsourced solutions to small and medium-sized enterprises (SMEs) and large global enterprises. Combining unrivaled expertise and capabilities across industries and business functions, we bring fresh approaches to strategy and operational performance by delivering the right BPO and customer management solutions that span the entire customer lifecycle.

As a leading business process outsourcing provider of customer management solutions, we are committed to delivering an outstanding customer experience with every interaction. Visit Magellan-Solutions.com to learn more about our credit card processing services. You can also contact us now and receive a complimentary 60-minute consultation.