Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

For most people, having a house is a top priority. Having a home provides a tremendous sense of fulfillment and security. Using a mortgage makes it easier for people to own their own homes, where the house itself becomes the collateral for the loan. The best part about a mortgage is that it is typically long-term, allowing individuals to make payments over a span of 25 to 30 years. However, many lenders worldwide still struggle with a paper-based and manual mortgage process. The limitations of lenders worldwide lead to frustrated customers who are eager for their mortgage approval. Fortunately, it is now possible for struggling lenders to outsource digital mortgage through business process outsourcing (BPO). Thus, lenders worldwide should leverage digital mortgage BPO for smarter, faster, and paperless processing.

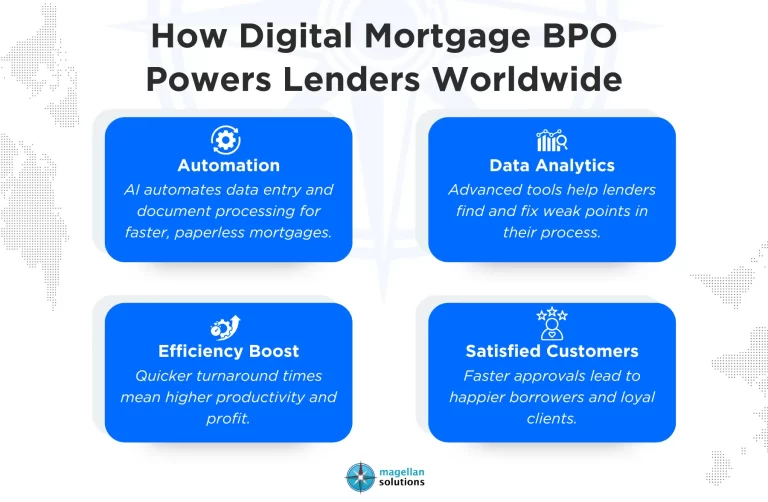

How Digital Mortgage BPO Powers Lenders Worldwide

- Automation: Most providers of digital mortgage BPO services already have access to artificial intelligence (AI) to automate the processing of mortgages. There is no longer a need for lenders to do data entry tasks or process documents manually. Thus, lenders worldwide will surely appreciate having faster and paperless mortgage processing.

- Data Analytics: Digital mortgage BPO services provide lenders with access to advanced analytics. These tools enable lenders to understand their areas for improvement in mortgage processing. Thus, lenders can eventually take actions to address their weaknesses and manage risks appropriately.

- Efficiency Boost: The automation of mortgage processing through digital mortgage BPO services will enable lenders worldwide to operate more efficiently. Turnaround times in mortgage processing will become faster for the convenience of the customers. Thus, lenders worldwide will become more productive and profitable in the long run.

- Satisfied Customers: Mortgage applicants never want to wait a long time for loan approval. The good thing is that digital mortgage BPO services can certainly help in making customers happy and satisfied. Having satisfied customers is what will propel lenders worldwide to greater heights.

Why Choose Magellan Solutions for Digital Mortgage BPO Services?

- Expertise: We make sure that we offer a wide range of digital mortgage BPO services for lenders. We provide comprehensive services, including processing, underwriting, closing, and post-closing support, to provide convenience for lenders. Thus, lenders can have confidence in choosing us as their outsourcing partner.

- Cost Reduction: Lenders no longer need to invest a significant amount of money in transitioning to a digital mortgage. Instead, lenders can just hire us and trust our digital mortgage BPO services to achieve cost reduction. We consistently find ways to meet lenders’ expectations while also enabling them to achieve significant cost savings.

- Productivity Boost: We aim to help lenders increase their productivity by simplifying their transition to digital mortgage services. Lenders will have more time to focus on their core activities once our mortgage BPO services are in place. When lenders are more productive, this also means that their customers are happier.

- Collaborative Approach: We recognize that lenders may have numerous questions about mortgage BPO services. The good thing is that we are ready to collaborate with lenders to understand their needs and requirements. We are confident that our collaborative efforts can help lenders in numerous ways.

The Bottom Line

The idea of digital mortgage BPO for future-ready lenders is fascinating and relevant. Lenders must find ways to transition to digital mortgage processing to remain competitive. The good thing is that there are many outsourcing providers ready to help lenders transition to digital mortgage processing. However, the challenge for lenders is to find the right outsourcing partner to get the best results. The ideal outsourcing partner is one with the experience and expertise in digital mortgage processing.

Interested in Digital Mortgage BPO Services?

Magellan Solutions is a provider of inbound and outbound call center services, as well as business processing outsourcing, in the Philippines. The company has extensive experience in providing best-in-class outsourced solutions to small and medium-sized enterprises (SMEs) as well as large global enterprises. Combining unrivaled expertise and capabilities across industries and business functions, we bring fresh and new approaches to strategies and operational performance of business operations by delivering the right BPO and customer management solutions that span the entire customer lifecycle.

As a leading business process outsourcing provider of customer management solutions, we are committed to delivering an outstanding customer experience with every interaction. Visit Magellan-Solutions.com to learn more about our digital mortgage BPO services. You can also contact us now and receive a complimentary 60-minute consultation.