Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

Boosting Collections with Credit Card Processing

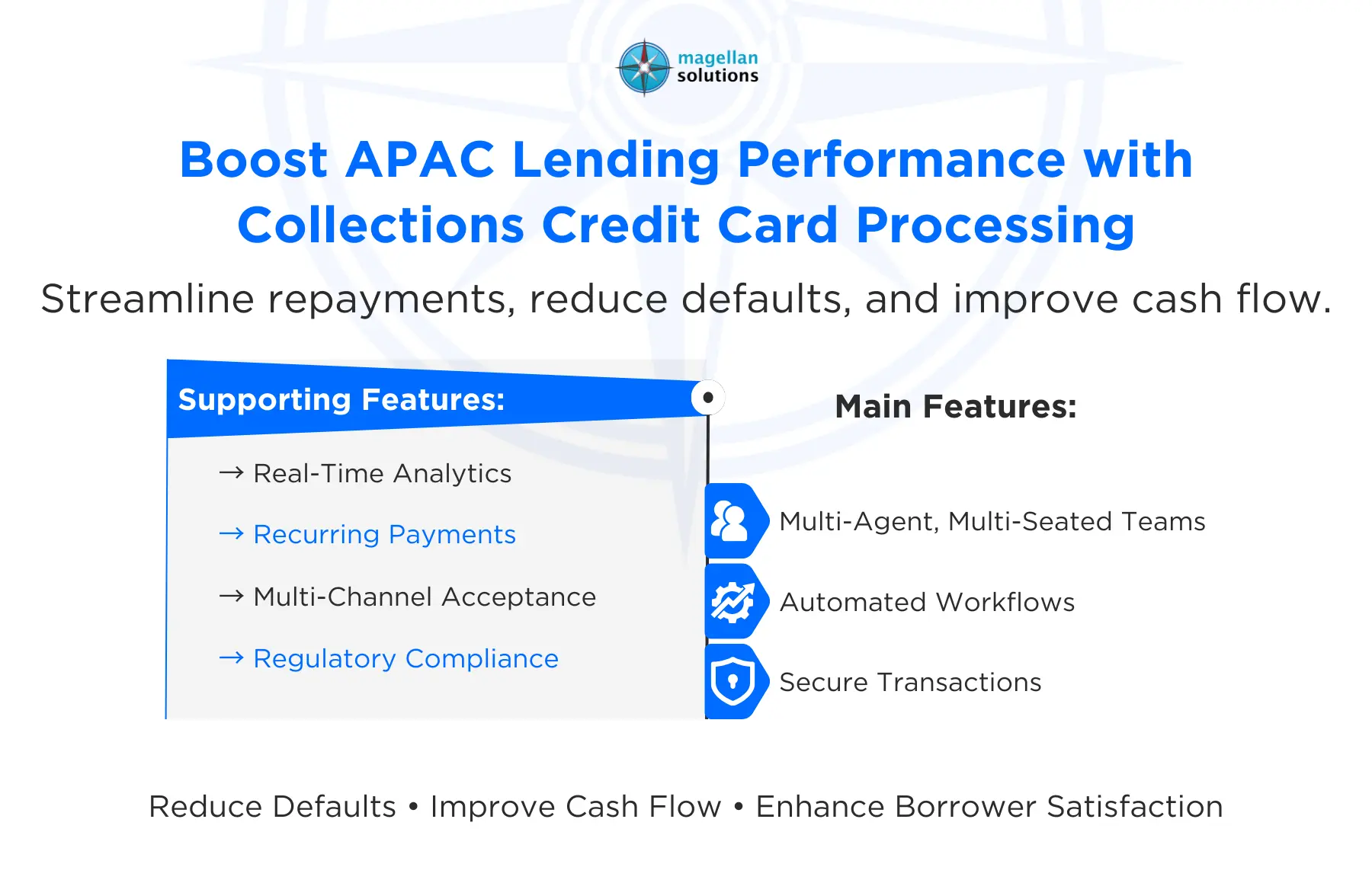

Collections processing services give APAC fintech lenders the tools they need to manage repayments efficiently and reduce financial friction. At the center of this is collections credit card processing, which streamlines payments, ensures accuracy, and keeps borrowers on track. By integrating these systems, lenders can handle high volumes of transactions, reduce errors, and free their teams to focus on strategic growth rather than repetitive tasks. The result is faster collections, happier borrowers, and smoother operations.

Why Collections Credit Card Processing Matters for APAC Lenders

Handling repayments across the Asia-Pacific region can be tricky. Diverse regulations, multiple currencies, and different banking standards all complicate collections. Collections credit card processing simplifies this landscape. Payments happen automatically, accounts stay updated in real-time, and reconciliation headaches vanish.

Here’s what lenders see when they adopt these systems:

-

Real-time Payment Updates: Every transaction posts instantly, keeping ledgers accurate.

-

Tighter Security: PCI-compliant systems protect sensitive cardholder data.

-

Flexible Workflows: Rules for retries, partial payments, and settlements can be tailored for each portfolio.

-

Scalable Teams: Multi-agent, multi-seated setups ensure no volume surge ever overwhelms operations.

With these advantages, lenders can maintain strong collections performance without stretching staff or resources.

Core Features of Collections Credit Card Processing

-

Recurring Payments Made Simple

Automated billing schedules let borrowers pay on time without thinking about it. Recurring payments reduce defaults, provide steady cash flow, and make collections predictable. -

Multiple Channels, One Platform

Borrowers can pay through online portals, mobile apps, or phone lines, all managed from a single system. Convenience improves repayment rates and reduces friction in every transaction. -

Insightful Analytics

Dashboards track payments, highlight at-risk accounts, and help lenders tweak their strategies. The system turns raw transaction data into actionable intelligence. -

Fraud Protection and Compliance

Built-in safeguards monitor for suspicious activity while adhering to regional regulations. Lenders stay compliant, and borrowers’ data stays secure.

How Collections Processing Services and Credit Card Processing Work Together

Pairing collections processing services with collections credit card processing delivers measurable results:

-

Cash Flow Stabilization: Automated processing accelerates funds collection, reducing bottlenecks.

-

Operational Efficiency: Multi-agent, multi-FTE teams handle spikes in transaction volume without missing a beat.

-

Better Borrower Experience: Flexible payment options keep borrowers satisfied and engaged.

-

Lower Default Rates: Automated retries and smart scheduling ensure repayments happen more consistently.

Combining skilled teams with smart technology gives lenders both efficiency and reliability.

APAC Success Story

A mid-sized APAC fintech lender adopted collections credit card processing along with multi-agent collections services. The results?

-

Late payments dropped by 25% in the first quarter.

-

Successful recurring transactions rose 40%.

-

Account tracking improved, making intervention for high-risk borrowers precise.

-

Borrowers appreciated flexible, multi-channel payment options.

This shows that pairing modern credit card processing with capable collections teams directly improves financial outcomes and operational stability.

Choosing the Right Partner for Collections Credit Card Processing

Not all providers offer the same level of support. APAC lenders should look for:

-

Scalable Operations – Teams should be multi-agent and multi-seated, ready for peaks in volume.

-

Regulatory Compliance – Providers must follow local financial regulations and protect sensitive data.

-

Seamless Integration – Platforms should work smoothly with existing CRMs, loan management, and reporting systems.

-

Actionable Analytics – Real-time insights allow teams to make smarter, faster decisions.

A trusted partner ensures consistency, compliance, and optimal collections results.

Best Practices to Maximize Collections Performance

Using collections credit card processing effectively means more than automation. Top-performing lenders:

-

Send Automated Reminders: Keeps borrowers on schedule and reduces late payments.

-

Segment Accounts Strategically: Different strategies for high-risk vs. low-risk accounts improve recovery rates.

-

Monitor Performance Continuously: Analytics guide adjustments and optimize workflow.

-

Leverage Multi-Agent Teams: Ensures coverage across APAC’s time zones and transaction peaks.

These approaches keep collections running smoothly while maintaining borrower trust.

Conclusion: Elevate Collections with Magellan Solutions

For APAC fintech lenders, collections credit card processing is a powerful tool that improves repayment rates, reduces operational strain, and scales with your portfolio. When paired with collections processing services, especially multi-agent, multi-seated teams, it transforms how lenders manage transactions.

Magellan Solutions delivers these services with experienced teams that handle high-volume collections, support multiple channels, and ensure operational efficiency. Partnering with Magellan Solutions helps APAC lenders boost collections performance and maintain regulatory compliance while keeping borrowers satisfied.

Take Charge of Your Collections Today: Boost repayment efficiency and operational excellence with Magellan Solutions. Explore our multi-agent collections solutions for APAC fintech lenders at Magellan-Solutions.com