Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

Faster Loan Approvals Through Mortgage Process Outsourcing

Borrowers don’t just want a loan—they want it quickly. Waiting weeks for approvals feels outdated in a world where most services are instant. But lenders know the reality: verifying documents, running compliance checks, and handling volumes of applications often slows everything down. That’s where mortgage loan process outsourcing comes in. By partnering with a specialized BPO, lenders can clear bottlenecks, shorten turnaround times, and give borrowers the faster, smoother experience they expect.

Why Loan Delays Are Costly

Delays in loan approvals don’t just frustrate customers—they hurt business. When applications pile up:

- Borrowers lose patience and sometimes move to a competitor offering quicker service.

- Lenders miss revenue opportunities by processing fewer loans.

- Compliance risk rises when overwhelmed teams overlook small but important details.

In short, a sluggish loan process undermines both customer trust and profitability. That’s why many institutions are turning to loan process outsourcing as a way to stay efficient without stretching internal teams too thin.

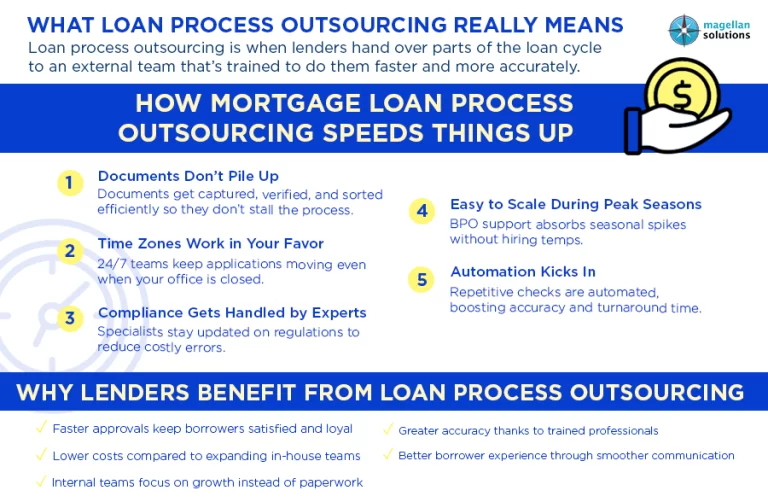

What Loan Process Outsourcing Means

So, what exactly is loan process outsourcing? In simple terms, it’s when lenders hand over parts of the loan cycle—like document review, borrower verification, underwriting support, or compliance checks—to an external team that’s trained to do them faster and more accurately.

It’s not about giving up control. Core decisions still sit with the lender. Outsourcing just takes the repetitive, labor-heavy work off their plate so the in-house team can focus on relationship-building and strategy.

How Mortgage Loan Process Outsourcing Speeds Things Up

Bringing a BPO into the picture changes the tempo of loan approvals. Here’s how:

- Documents Don’t Pile Up

BPO teams use efficient systems to capture, verify, and sort paperwork so files don’t get stuck in limbo. Everything moves forward without the bottlenecks that often slow down in-house processing.

- Time Zones Work in Your Favor

Most outsourcing partners operate 24/7. That means while your office is closed, someone else is still working through applications. The net effect is a much faster loan cycle.

- Compliance Gets Handled by Experts

Mortgage rules shift constantly. Outsourcing partners stay on top of those changes so every file stays compliant—reducing both errors and the risk of penalties.

- Easy to Scale During Peak Seasons

Application spikes happen. Instead of scrambling to hire temps, outsourcing gives you a ready-made team that can absorb extra work when you need it.

- Automation Kicks In

BPO firms often bring automation tools that speed up tasks like data checks or borrower assessments. That cuts down on human error while freeing up staff for higher-value work.

Why Lenders Benefit from Loan Process Outsourcing

Once lenders shift some responsibilities to a BPO partner, the advantages are hard to ignore:

- Faster approvals keep borrowers satisfied and loyal.

- Lower costs compared to expanding in-house teams.

- Greater accuracy thanks to specialized staff and automation.

- Better customer experience with more consistent communication.

- Focus on core priorities like growing client relationships instead of drowning in paperwork.

Clearing Up Misconceptions About Outsourcing

Despite the benefits, some lenders hesitate—and usually for the wrong reasons.

- “We’ll lose control.” In reality, BPOs follow your workflows and act as an extension of your team.

- “Data won’t be safe.” Reliable providers use encrypted systems and strict access controls to protect sensitive borrower information.

- “The quality won’t match our standards.” Top providers live and breathe loan processing. Their accuracy rates often exceed in-house teams.

The key is choosing a partner with a strong track record and clear alignment with your compliance standards.

When Outsourcing Makes the Most Sense

Not every lender needs to outsource all the time. But if you notice any of these signs, it’s worth considering:

- Your loan volumes spike seasonally, and your team struggles to keep up.

- Compliance demands are eating up resources you don’t have.

- You’ve got persistent backlogs and unhappy borrowers waiting on approvals.

- Growth is outpacing your internal capacity.

In these cases, outsourcing isn’t just a convenience—it can be the difference between keeping or losing business.

Looking Ahead: Outsourcing as a Competitive Edge

The lending industry is only getting faster and more digital. Borrowers expect near-instant responses, and competitors are adopting automation at scale. But not every institution can invest millions in technology overnight.

That’s where loan process outsourcing acts as a bridge. With the right partner, lenders can access advanced tools, compliance expertise, and scalable teams—without the heavy upfront costs. It’s a practical way to stay competitive in a market that’s moving quickly.

Conclusion: A Smarter Way Forward with Magellan Solutions

Loan delays don’t just frustrate borrowers—they cost institutions business. Mortgage loan process outsourcing provides a proven way to move faster, reduce errors, and maintain strict compliance. By offloading time-intensive tasks to a trusted partner, lenders can focus on growth while still meeting the high expectations of today’s borrowers.

At Magellan Solutions, we’ve helped financial institutions streamline their workflows and speed up approvals with tailored loan process outsourcing support. With secure systems, experienced staff, and a commitment to quality, we make sure lenders deliver not only faster but also better.

Ready to stop losing time—and customers—to loan delays? Contact Magellan Solutions today and discover how outsourcing can enhance your loan process.