Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

Underserved populations and small businesses urgently need financial assistance for various reasons. The sad reality is that traditional financial institutions are unable to consistently help underserved populations and small businesses. Fortunately, fintech lenders are ready to address the shortcomings of traditional financial institutions. In Australia, Moula, Prospa, and Judo Bank are among the best fintech lenders. However, many Australian fintech lenders struggle to recover outstanding payments, which is affecting their profitability. Fortunately, payment recovery services are now available to help Australian fintech lenders. Thus, Australian fintech lenders must leverage debt collection for credit card services to streamline the recovery of outstanding payments.

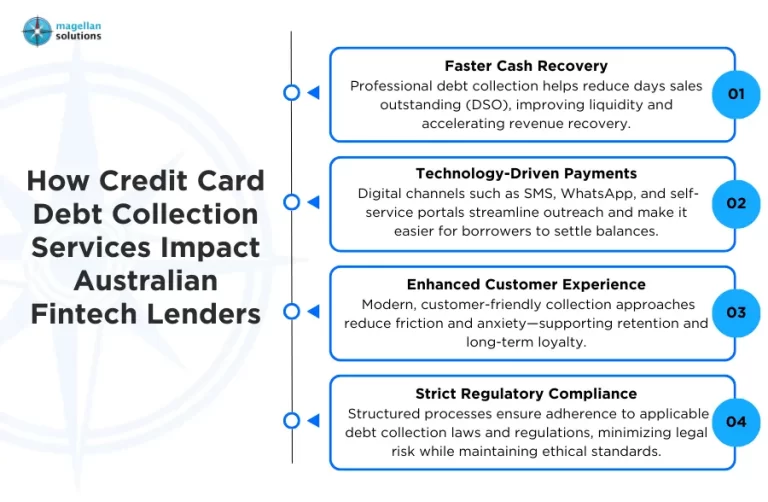

How Credit Card Debt Collection Services Impact Australian Fintech Lenders

- Better Cash Recovery: Debt collection for credit card services can help Australian fintech lenders reduce their days sales outstanding (DSO) for better cash recovery. Thus, it becomes easier for Australian fintech lenders to achieve sustained growth as their cash recovery improves.

- Technology Boost: Using digital tools such as SMS, WhatsApp, and self-service portals in debt collection for credit card streamlines the recovery of outstanding payments. Thus, Australian fintech lenders will appreciate getting a significant technology boost through outsourcing.

- Improved Customer Experience: Debt collection for credit card services help deliver a better customer experience by reducing friction and anxiety. Thus, when the customers of Australian fintech lenders consistently have a positive experience, they eventually develop loyalty.

- Strict Compliance: Debt collection for credit card services ensure strict compliance with the Fair Debt Collection Practices Act (FDCPA) and other applicable laws and regulations. Thus, Australian fintech lenders won’t have to worry about the risk of fines for non-compliance.

Why Choose Magellan Solutions for Credit Card Debt Collection Services?

- Expertise: We have experienced agents with deep expertise in debt collection. Our agents go through rigorous training as part of their continuous improvement. Thus, Australian fintech lenders should hire us as their outsourcing partner given our expertise.

- Cost Savings: It is just too costly and time-consuming for Australian fintech lenders to hire and train more debt collectors. Instead, Australian fintech lenders can just rely on our debt collection services to achieve substantial cost reduction. Australian fintech lenders will appreciate having cost-saving emergency funds in the future.

- Productivity Boost: Since Australian fintech lenders won’t have to worry about debt collection anymore, they can expect to get a productivity boost. Australian fintech lenders will have more time to focus on revenue-driving activities.

- Collaborative Approach: We understand that Australian fintech lenders may have questions or concerns about our debt collection services. We are ready to collaborate with Australian fintech lenders to find out how we can help. We are confident that we can meet the expectations of Australian fintech lenders through collaboration.

The Bottom Line

Debt collection for credit card for Australian fintech lenders delivers impressive results. Australian fintech lenders must leverage outsourcing to realize its benefits. However, Australian fintech lenders must also choose the right outsourcing partner to maximize the benefits of outsourcing. Australian fintech lenders should select an experienced, respected outsourcing partner to achieve the best results.

Interested in Credit Card Debt Collection Services?

Magellan Solutions is a provider of inbound and outbound call center services, as well as business processing outsourcing, in the Philippines. The company has extensive experience providing best-in-class outsourced solutions to small and medium-sized enterprises (SMEs) and large global enterprises. Combining unrivaled expertise and capabilities across industries and business functions, we bring fresh approaches to strategy and operational performance by delivering the right BPO and customer management solutions that span the entire customer lifecycle.

As a leading business process outsourcing provider of customer management solutions, we are committed to delivering an outstanding customer experience with every interaction. Visit Magellan-Solutions.com to learn more about our debt collection services. You can also contact us now and receive a complimentary 60-minute consultation.