Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

B2B (business-to-business) payments must always be safe and secure to ensure profitability. B2B payments are typically larger, more complex, and have longer payment periods. The good news is that B2B finance providers are now available to help process B2B payments and offer financing solutions. In Australia, Octet, Kriya, Butn, and Bizcap are some examples of successful B2B finance providers. However, many Australian B2B finance providers struggle to achieve satisfactory recovery rates on credit card payments. Fortunately, business credit card collections are now available to help Australian B2B finance providers. Thus, Australian B2B finance providers should leverage a business collections team to improve their long-term recovery rates. Australian B2B finance providers won’t regret relying on business credit card collections.

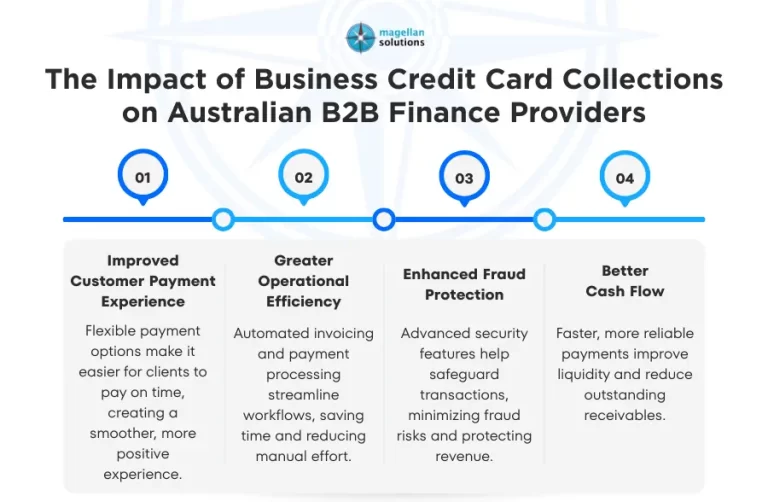

The Impact of Business Credit Card Collections on Australian B2B Finance Providers

- Better Cash Flow: When Australian B2B finance providers rely on business credit card collections, they can expect faster payments. Faster payments help stabilize and improve the cash flow of Australian B2B finance providers. Thus, Australian B2B finance providers can thrive with a better cash flow.

- Improved Fraud Protection: Business credit card collections use the best security measures to fight against fraud. Encryption is just one of the many security measures that can protect Australian B2B finance providers against fraudulent activities. Thus, Australian B2B finance providers won’t have to worry about possible losses due to fraudulent transactions.

- Efficiency Boost: Automated invoicing in business credit card collections helps Australian B2B finance providers improve efficiency. Additionally, ongoing payment reminders will help Australian B2B finance providers operate more efficiently.

- Positive Payment Experience: Flexible payment options in business credit card collections deliver a satisfying customer experience. These flexible payment options make it easier for the customers of Australian B2B finance providers to settle their payments. Thus, Australian B2B finance providers can expect higher customer retention rates as a result of a positive payment experience.

Why Choose Magellan Solutions for Credit Card Collections Services?

- Expertise: Our agents have extensive knowledge, skills, and experience in business credit card collections. We ensure our agents receive ongoing training to further enhance their competence. Thus, Australian B2B finance providers should engage us as their outsourcing partner given our expertise.

- Cost Reduction: Australian B2B finance providers can significantly reduce costs by eliminating the need to hire and train collections agents. Instead, Australian B2B finance providers can just rely on our business credit card collections services to reduce costs. Australian B2B finance providers will appreciate having significant cost savings for future use.

- Robust Security: We take security very seriously. We understand that strong security helps establish a BPO company’s credibility. We are proud to hold ISO 27001, PCI DSS, and HIPAA certifications, demonstrating our commitment to maintaining high security standards. Australian B2B finance providers can rest assured that their data is secure with us and that there is no data leakage.

- Collaborative Approach: We understand that Australian B2B finance providers may have preferences regarding our business credit card collections. We are ready to collaborate with Australian B2B finance providers to set expectations. We are confident that we can find ways to help Australian B2B finance providers through collaboration.

The Bottom Line

Business credit card collections in the Australian finance industry are very effective. Thus, Australian B2B finance providers should leverage outsourcing to realize its benefits. However, Australian B2B finance providers should choose the right outsourcing partner to maximize the benefits of outsourcing. Ideally, Australian B2B finance providers should choose an outsourcing partner with a proven track record to get the best results.

Interested in Credit Card Collections Services?

Magellan Solutions is a provider of inbound and outbound call center services, as well as business processing outsourcing, in the Philippines. The company has extensive experience providing best-in-class outsourced solutions to small and medium-sized enterprises (SMEs) and large global enterprises. Combining unrivaled expertise and capabilities across industries and business functions, we bring fresh approaches to strategy and operational performance by delivering the right BPO and customer management solutions that span the entire customer lifecycle.

As a leading business process outsourcing provider of customer management solutions, we are committed to delivering an outstanding customer experience with every interaction. Visit Magellan-Solutions.com to learn more about our credit card collections services. You can also contact us now and receive a complimentary 60-minute consultation.