Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

The Hidden Engine Powering Finance: Outsourcing in the Philippines

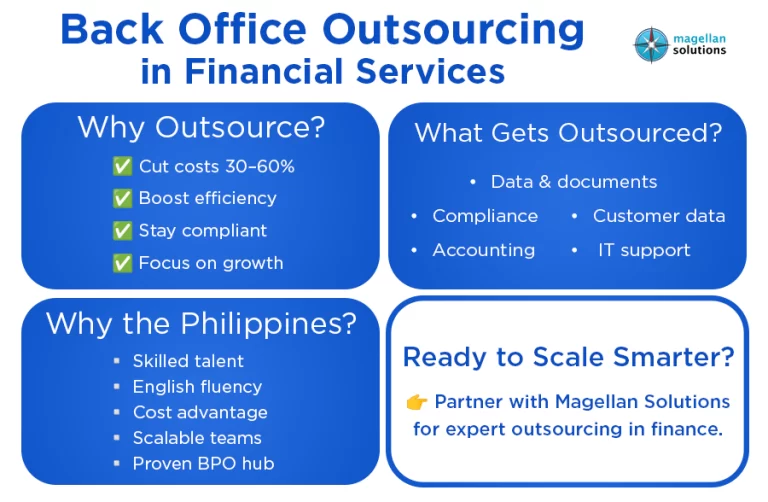

Finance has always been a high-stakes game—where precision, speed, and compliance can make or break a business. Yet behind the polished customer interactions and high-level decision-making, there’s a mountain of repetitive but critical tasks keeping everything afloat. That’s where back-office support outsourcing services Philippines have quietly become a game-changer.

For many banks, insurers, and investment firms, back-office outsourcing in the financial services industry is no longer just a cost-cutting measure. It’s a way to free up resources, tighten compliance, and scale without burning through budgets. In a sector that’s only getting more complex, outsourcing has shifted from being a “nice-to-have” to a strategic necessity.

What Does Back Office Outsourcing in Financial Services Cover?

The “back office” is often invisible to customers, but it’s the engine room of any financial institution. Think about the hours spent processing loan applications, reconciling accounts, running compliance checks, managing records, or maintaining IT systems. None of these directly generates revenue—but without them, the whole operation falls apart.

Back-office outsourcing in financial services takes those heavy-lift tasks and shifts them to specialized providers who can handle them more efficiently. That doesn’t just lighten the load for internal teams; it also means fewer bottlenecks, fewer errors, and faster turnaround times.

And when you’re dealing with financial data, precision isn’t optional—it’s survival. Outsourcing partners, especially those in the Philippines, have built reputations for reliability and accuracy, which is exactly what financial firms need.

Why the Philippines Leads in Back Office Support Outsourcing

The Philippines isn’t new to the outsourcing stage—it’s been one of the world’s top players for decades. But when it comes to financial services, a few things make it stand out:

- A strong talent pool. The country produces thousands of finance, accounting, and IT graduates every year, many of whom are trained specifically for global outsourcing work.

- Cultural and linguistic alignment. English fluency is high, and business practices align closely with Western markets, making collaboration smoother.

- Cost advantage. Labor costs are significantly lower than in the U.S. or Europe, but the quality of work is on par.

- Agility. Providers offering back-office support outsourcing services Philippines can ramp teams up or down quickly depending on seasonal demands or business shifts.

For financial companies constantly balancing costs and compliance, the Philippines offers both affordability and expertise.

The Real Payoff of Back Office Outsourcing in Financial Services

It’s tempting to think outsourcing is only about saving money—but that’s just the starting point. Financial institutions that have embraced outsourcing usually point to a few other big wins:

- Lower Costs Without Cutting Corners

Hiring, training, and maintaining in-house teams for repetitive but critical tasks is expensive. Outsourcing trims those costs without compromising accuracy or professionalism.

- More Efficient Operations

When experts are dedicated to handling loan processing, reconciliations, or compliance reports, things move faster—and errors drop. That means smoother operations across the board.

- Stronger Grip on Compliance

Financial services live and die by compliance. Regulations shift constantly, and falling behind can be catastrophic. With back-office outsourcing in financial services, compliance teams get support from professionals who stay up to date and minimize risk.

- Room to Focus on Growth

Instead of sinking resources into endless admin work, financial firms can double down on what matters—building client relationships, innovating new products, and growing market share.

- Built-in Access to Tech

Outsourcing partners often bring advanced systems, automation tools, and secure platforms into the mix. That saves financial institutions from heavy capital investments in technology.

What Financial Firms Commonly Outsource

Not every back-office task needs to stay in-house. Some of the most frequently outsourced functions include:

- Document and data processing for claims, applications, and transactions

- Compliance monitoring and reporting to keep up with ever-changing regulations

- Accounting support like bookkeeping, payroll, and reconciliations

- Customer data management for secure handling of sensitive records

- IT and systems support to ensure platforms run smoothly and safely

These aren’t glamorous tasks, but they’re essential. And handing them over to providers of back-office support outsourcing services Philippines keeps them efficient, accurate, and cost-effective.

Why the Philippines Is a Strategic Choice for Financial Services

It’s not just about price—it’s about trust. Financial firms choose the Philippines because providers there combine technical skills with reliability and strong data security practices. Many are already aligned with international standards like GDPR, ISO, and PCI DSS, giving peace of mind to institutions that can’t afford breaches.

There’s also the maturity of the BPO industry in the country. For over two decades, global banks, insurers, and investment firms have relied on the Philippines for everything from customer service to compliance processing. That track record matters when money and reputation are on the line.

Looking Ahead: The Future of Outsourcing in Finance

Outsourcing isn’t static—it’s evolving right alongside the financial industry. A few trends are shaping the future:

- AI and automation. Manual data entry is gradually being replaced by machine learning tools that boost speed and accuracy.

- Analytics-driven services. Outsourcing providers are increasingly offering insights from the data they process, helping financial firms make smarter decisions.

- Hybrid outsourcing models. Some companies are blending internal teams with outsourced partners for maximum flexibility.

- Focus on sustainability. More financial firms are seeking partners who can deliver not just efficiency, but also eco-friendly operations.

Given these shifts, back-office support outsourcing services Philippines won’t just remain relevant—they’ll become even more critical for financial firms looking to adapt.

Conclusion: A Smarter Path for Financial Institutions

The financial world doesn’t leave much room for inefficiency. Costs are rising, compliance is tougher than ever, and customers expect faster, smoother service. Back-office outsourcing in financial services gives companies a way to meet those demands without draining resources.

By partnering with trusted providers of back-office support outsourcing services Philippines, financial institutions can reduce overhead, strengthen compliance, and keep their attention on the work that drives growth.

At Magellan Solutions, we’ve spent nearly two decades helping financial firms streamline their operations with customized outsourcing solutions. Our teams bring both expertise and flexibility to the table—so you get cost savings without compromise.

Looking to sharpen your financial operations? Reach out to Magellan Solutions today for a free consultation and see how we can help your business thrive.