Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

As everything becomes more modern, it should not be surprising that finance has modernized as well. The fintech companies are responsible for modernizing finance by improving access to services. Fintech companies have introduced automation in finance, leading to lower costs and faster transactions. In the U.S., PayPal, Stripe, and Chime are some of the top fintech companies. However, many U.S. fintech companies continue to struggle with security and compliance issues. The good thing is that data management for financial services is now available to help U.S. fintech companies. Thus, U.S. fintech companies should leverage financial data management to overcome security and compliance issues. U.S. fintech companies won’t regret relying on data management for financial services.

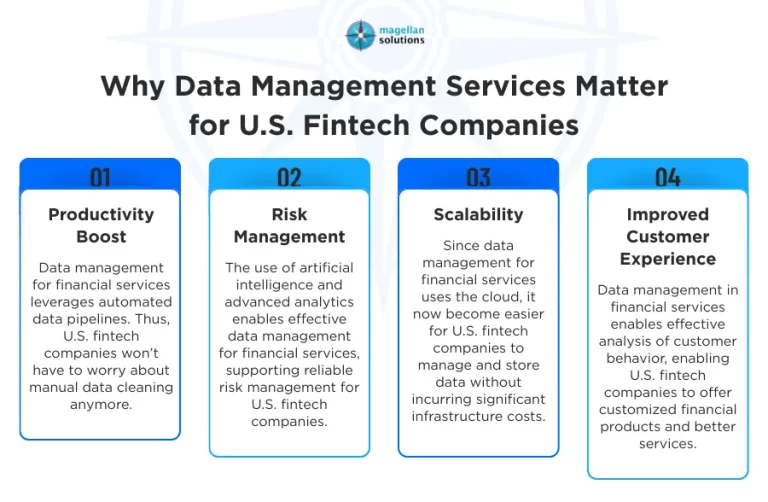

Why Data Management Services Matter for U.S. Fintech Companies

- Productivity Boost: Data management for financial services leverages automated data pipelines. Thus, U.S. fintech companies won’t have to worry about manual data cleaning anymore, as it is time-consuming. Instead, U.S. fintech companies will now have more time to do other important tasks.

- Scalability: Since data management for financial services uses the cloud, it now become easier for U.S. fintech companies to manage and store data. U.S. fintech companies can also analyze large volumes of data without incurring significant infrastructure costs.

- Risk Management: The use of artificial intelligence enables more effective data management in financial services, supporting more reliable risk management. U.S. fintech companies will also benefit from advanced analytics to improve credit scoring.

- Improved Customer Experience: Data management in financial services enables effective analysis of customer behavior. The transaction history will always provide clues about customer behavior. Thus, U.S. fintech companies can be confident they can offer customized financial products and better services.

Why Choose Magellan Solutions for Data Management Services?

- Expertise: Our agents have extensive knowledge, skills, and experience in financial services data management. We ensure our agents consistently undergo rigorous training to support continuous improvement. Thus, U.S. fintech companies can confidently hire us as their outsourcing partner given our expertise.

- Cost Savings: We help U.S. fintech companies significantly reduce costs by eliminating the need to hire and train additional staff. Instead, U.S. fintech companies can rely on our data management for financial services to achieve substantial cost reductions. U.S. fintech companies will appreciate the cost savings they can use to pursue future investment opportunities.

- Robust Security: We take security very seriously. We understand that strong security helps establish a BPO company’s credibility. We are proud to hold ISO 27001, PCI DSS, and HIPAA certifications, demonstrating our commitment to maintaining high security standards. U.S. fintech companies can rest assured that their data is secure with us and that there is no data leakage.

- Collaborative Approach: We understand that U.S. fintech companies may have questions about our data management for financial services. We are ready to collaborate with U.S. fintech companies to know how we can help. We are confident that we can meet the expectations of the U.S. fintech companies through collaboration.

The Bottom Line

Data management for financial services drives growth in the U.S. fintech industry. U.S. fintech companies should begin to appreciate the significant benefits of outsourcing. However, U.S. fintech companies should choose the right outsourcing partner to maximize the benefits of outsourcing. The wise move for U.S. fintech companies is to choose a proven, experienced outsourcing partner to achieve the best results.

Interested in Data Management Services?

Magellan Solutions is a provider of inbound and outbound call center services, as well as business processing outsourcing, in the Philippines. The company has extensive experience providing best-in-class outsourced solutions to small and medium-sized enterprises (SMEs) and large global enterprises. Combining unrivaled expertise and capabilities across industries and business functions, we bring fresh approaches to strategy and operational performance by delivering the right BPO and customer management solutions that span the entire customer lifecycle.

As a leading business process outsourcing provider of customer management solutions, we are committed to delivering an outstanding customer experience with every interaction. Visit Magellan-Solutions.com to learn more about our data management services. You can also contact us now and receive a complimentary 60-minute consultation.