Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

Financial services firms offer a range of products and services to individuals and businesses. For example, banks provide loans and mortgages while accepting deposits and payments. Insurance companies provide security and peace of mind in the event of unexpected events. Investment firms properly handle assets and investments to achieve sustained growth. In the U.S., some of the top financial services firms include JPMorgan Chase, Bank of America, Wells Fargo, and Goldman Sachs. However, many other U.S. financial services firms struggle to manage vendor payments and reconciliations efficiently. Fortunately, many business process outsourcing (BPO) companies now offer professional accounts payable support services. Thus, U.S. financial services firms should leverage accounts payable BPO to improve vendor payment management.

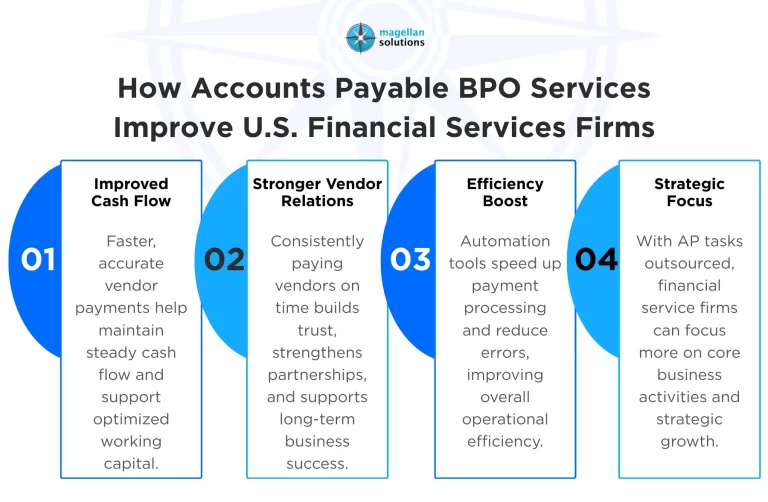

How Accounts Payable BPO Services Improve U.S. Financial Services Firms

- Improved Cash Flow: U.S. financial services firms must maintain consistent cash flow. The good thing is that accounts payable BPO services can help U.S. financial services firms improve cash flow. Prompt processing of vendor payments ensures U.S. financial services firms maintain optimized working capital.

- Stronger Vendor Relations: U.S. financial services firms can expect stronger vendor relationships through accounts payable BPO services. Once vendor payments are settled on time consistently, it will help establish trust and confidence. When U.S. financial services firms build strong relationships with vendors, they are well-positioned to achieve sustained success.

- Efficiency Boost: The providers of accounts payable BPO services already have access to tools that automate repetitive tasks. Thus, U.S. financial services firms can expect an efficiency boost as vendor payment processing times shorten. U.S. financial services firms can also expect all vendor payments to be accurate.

- Strategic Focus: Once U.S. financial services firms start relying on accounts payable BPO services, their strategic focus will improve. U.S. financial services firms will now have more time to focus on core activities without managing vendor payments and reconciliations.

Why Choose Magellan Solutions for Accounts Payable BPO Services?

- Expertise: We have experts with impressive knowledge, skills, and experience in handling vendor payments and reconciliations. Our experts consistently train as part of their continuous improvement. Thus, we are confident that our accounts payable BPO services can help U.S. financial services firms achieve greater heights.

- Cost Reduction: We help U.S. financial services firms significantly reduce their overhead costs. There is no need for U.S. financial services firms to continue hiring and training staff to handle vendor payments. Instead, U.S. financial services firms can rely on our accounts payable BPO services to achieve significant cost savings.

- Flexibility: We recognize that U.S. financial services firms experience seasonal fluctuations. The good thing is that our accounts payable services are flexible enough to accommodate the needs of U.S. financial services firms. Thus, U.S. financial services firms can be confident in our flexibility as their outsourcing partner.

- Collaborative Approach: We understand that U.S. financial services firms may have preferences regarding accounts payable services. We are ready to collaborate with U.S. financial services firms to set expectations. We are confident we can meet the expectations of U.S. financial services firms through collaboration.

The Bottom Line

Accounts payable BPO for U.S. financial services firms is an excellent move. U.S. financial services firms should consider outsourcing vendor payments and reconciliations to improve management of these processes. However, U.S. financial services firms must also ensure they select the right outsourcing partner to achieve the best results. An outsourcing partner with proven credibility and expertise in providing accounts payable services is the best option.

Interested in Accounts Payable BPO Services?

Magellan Solutions is a provider of inbound and outbound call center services, as well as business processing outsourcing, in the Philippines. The company has extensive experience providing best-in-class outsourced solutions to small and medium-sized enterprises (SMEs) and large global enterprises. Combining unrivaled expertise and capabilities across industries and business functions, we bring fresh approaches to strategy and operational performance by delivering the right BPO and customer management solutions that span the entire customer lifecycle.

As a leading business process outsourcing provider of customer management solutions, we are committed to delivering an outstanding customer experience with every interaction. Visit Magellan-Solutions.com to learn more about our accounts payable BPO services. You can also contact us now and receive a complimentary 60-minute consultation.