Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

In today’s fast-moving insurance world, accuracy and speed aren’t luxuries—they’re expected. When someone files a claim, they want answers right away, not in a week. But let’s face it: rising claim volumes, changing regulations, and tight budgets can stretch internal teams to their limits. That’s where outsourcing insurance claims handling comes into play—not just as a quick fix, but as a smart, long-term move.

By teaming up with specialized service providers, insurers can take the pressure off their core staff, streamline operations, and stay competitive without losing sight of the customer experience. It’s about working smarter, not harder.

What It Really Means to Outsource Insurance Claims Handling

Outsourcing insurance claims handling isn’t about handing everything off and hoping for the best. It’s a strategic collaboration with a third-party provider to manage parts—or even all—of your claims process. That might include:

- Receiving and reviewing new claims

- Verifying coverage and customer details

- Managing paperwork and supporting documents

- Communicating with clients and third parties

- Supporting fraud prevention efforts

- Assisting with adjudication

- Handling backend reporting and data entry

These external teams follow your playbook, operate under your brand’s voice, and blend into your workflow like a natural extension of your business.

Why More Insurers Are Going the Outsourcing Route

Insurers are facing a perfect storm: higher operational costs, stricter compliance requirements, talent shortages, and the relentless demand for faster claims turnaround. It’s no wonder many are rethinking how they manage their claims department.

Faster Results, Fewer Bottlenecks

Outsourcing partners often have round-the-clock teams working across time zones, which helps slash delays. Claims don’t sit in a queue overnight—they get handled quickly, keeping your policyholders in the loop and satisfied.

Better Budget Control

Running a full in-house claims team isn’t cheap. Think salaries, onboarding, training, software, and office space. With outsourcing insurance claims handling, you shift to a model with predictable costs that scale with your needs. No more paying for idle capacity.

Less Risk, More Compliance

The right outsourcing partner stays current with industry regulations and quality standards. They’ve got built-in checks to catch errors before they become problems, and they’ll help you stay audit-ready year-round.

Focus Where It Matters Most

When your staff isn’t bogged down in admin tasks, they can focus on high-impact areas—like creating new insurance products, building customer relationships, or exploring new markets. Outsourcing frees up space for real innovation.

The Real-World Perks of Outsourcing Insurance Claims Handling

Let’s look at what outsourcing actually delivers, beyond the buzzwords.

1. Experts on Demand

You get trained insurance professionals from day one—people who speak your language, understand claims jargon, and know the ins and outs of compliance.

2. Built-In Tech Power

Most outsourcing partners come equipped with automation tools, AI-enhanced fraud detection, and integrated platforms. You won’t need to invest in expensive systems—they’ve already done it.

3. Happier Policyholders

When claims are processed quickly and communication is seamless, customers notice. Many BPOs handle customer-facing interactions, ensuring polite, helpful, and timely responses.

4. Around-the-Clock Support

Customers don’t operate on a 9–5 schedule, and neither should your claims team. Outsourcing gives you the ability to offer 24/7 service without burning out your internal staff.

5. Business Continuity, Built In

Disasters, pandemics, and tech outages happen. A solid BPO partner has redundancies and protocols in place to keep your claims operation running no matter what.

When Is the Right Time to Outsource?

It might be time to consider outsourcing if:

- Your claims are taking longer than they should

- You can’t keep up during high-volume seasons

- Your internal team is stretched thin

- Mistakes are happening more often

- You’re planning to scale but lack the infrastructure

Outsourcing also makes sense when your business is growing fast or going through a major shift, like a merger or system overhaul.

How to Choose the Right Partner

This decision matters. You want a partner that fits seamlessly with your brand and operations.

Here’s what to prioritize:

- Industry experience in insurance claims handling

- Flexible service levels that grow with you

- Strong data protection with compliance certifications

- Up-to-date technology and integration capabilities

- Transparent reporting and measurable KPIs

- Cultural alignment with your business values

Remember: you’re not just outsourcing tasks—you’re entrusting your brand’s reputation.

Where Outsourcing Is Headed

The future of outsourcing insurance claims handling is dynamic and tech-driven. We’re talking AI that detects fraud before it happens, real-time reporting dashboards, and chatbots that handle first-touch support.

Outsourcing will continue to evolve beyond basic processing to include advanced analytics, customer sentiment tracking, and predictive modeling. If your partner brings these tools to the table, you’re ahead of the game.

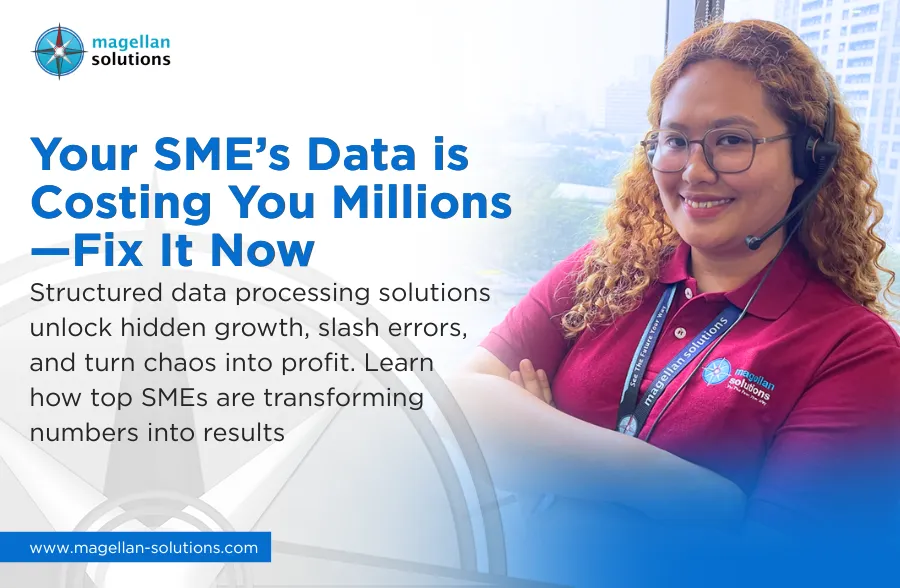

Why Magellan Solutions Is a Partner Worth Your Time

Magellan Solutions isn’t just another outsourcing vendor. With nearly 20 years of hands-on BPO experience, we understand what insurers need—and how to deliver it. Our team of trained professionals knows the details of outsourcing insurance claims handling, and we’re built to support compliance, quality, and efficiency from day one.

Whether you’re struggling with backlogs, planning to scale, or just want to free up your internal team, we’ll tailor our service to fit your needs. We don’t offer cookie-cutter solutions—just results you can measure.

It’s time to simplify your claims process and deliver a better experience for everyone involved.

Contact us now to explore how our claims handling solutions can move your business forward—faster, smarter, and with less stress.