Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

The stock market is a proven way for individuals and companies to generate profits. It is ordinary to see many buyers and sellers in the stock market who all want to make profits. However, the stock market can be very complicated for many buyers and sellers. The good news is that many brokers have the expertise and experience to help buyers and sellers make the right decisions. In the U.S., Charles Schwab, Fidelity Investments, and Vanguard are among the top brokers. Unfortunately, many U.S. brokers struggle to scale due to data-entry issues. Fortunately, outsourced insurance claims data entry is now available to help U.S. brokers. Thus, U.S. brokers should rely on outsourced claims support teams to achieve significant improvements. U.S. brokers won’t regret relying on insurance claims data entry, especially once they get a reliable outsourcing partner.

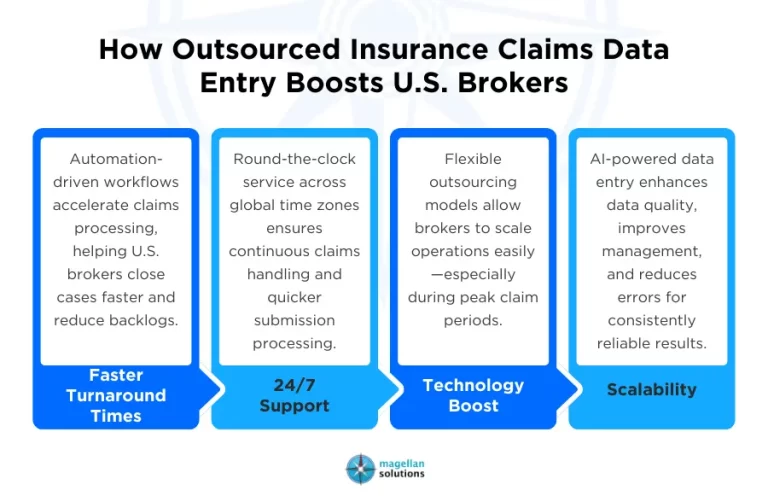

How Outsourced Insurance Claims Data Entry Boosts U.S. Brokers

- Fast Turnaround Times: Outsourced insurance claims data entry relies on automation, enabling faster turnaround. Thus, U.S. brokers can expect a significant reduction in claim cycle time once they have a dependable outsourcing partner.

- 24/7 Support: Most outsourced insurance claims data entry providers offer round-the-clock support across time zones. Thus, U.S. brokers can expect faster, more efficient processing of claim submissions, leading to satisfied customers over time.

- Scalability: U.S. brokers typically experience peak seasons when they are overwhelmed by insurance claims. The good news is that most outsourced insurance claims data entry providers can offer scalable services to meet the needs of U.S. brokers. Thus, U.S. brokers will no longer need to hire additional staff during peak seasons.

- Technology Boost: Using artificial intelligence for outsourced insurance claims data entry significantly improves data management and accuracy. Thus, U.S. brokers will appreciate a significant technology boost, enabling high-quality data entry.

Why Choose Magellan Solutions for Data Entry Services?

- Expertise: Our agents have extensive knowledge, skills, and experience in outsourced insurance claims data entry. We ensure our agents consistently train in insurance coding, including ICD-10 and EOBs (Explanation of Benefits), as part of our continuous improvement efforts. Thus, U.S. brokers can confidently hire us as their outsourcing partner, considering our expertise.

- Cost Reduction: There is no need for U.S. brokers to hire and train additional data-entry personnel. Instead, U.S. brokers can just hire us as their partner for outsourced insurance claims data entry to achieve significant cost reduction. U.S. brokers will appreciate the cost savings they can use in emergencies.

- Robust Security: We take security very seriously. We understand that strong security helps establish a BPO company’s credibility. We are proud to hold ISO 27001, PCI DSS, and HIPAA certifications, demonstrating our commitment to maintaining high security standards. U.S. brokers can rest assured that their data is secure with us and that there is no data leakage.

- Collaborative Approach: We understand that U.S. brokers may have questions and concerns about our outsourced insurance claims data entry. We are ready to collaborate with U.S. brokers to find out how we can help. We are confident we can meet U.S. brokers’ expectations through collaboration.

The Bottom Line

Outsourced insurance claims data entry for broker scaling delivers excellent results. U.S. brokers need to pursue outsourcing and experience its benefits. However, U.S. brokers must choose the right outsourcing partner to maximize the benefits of outsourcing. Ideally, U.S. brokers should choose an outsourcing partner with a proven track record and unquestionable expertise to get the best results.

Interested in Data Entry Services?

Magellan Solutions is a provider of inbound and outbound call center services, as well as business processing outsourcing, in the Philippines. The company has extensive experience providing best-in-class outsourced solutions to small and medium-sized enterprises (SMEs) and large global enterprises. Combining unrivaled expertise and capabilities across industries and business functions, we bring fresh approaches to strategy and operational performance by delivering the right BPO and customer management solutions that span the entire customer lifecycle.

As a leading business process outsourcing provider of customer management solutions, we are committed to delivering an outstanding customer experience with every interaction. Visit Magellan-Solutions.com to learn more about our data entry services. You can also contact us now and receive a complimentary 60-minute consultation.