Looking for an accurate quote for your outsourcing needs?

Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

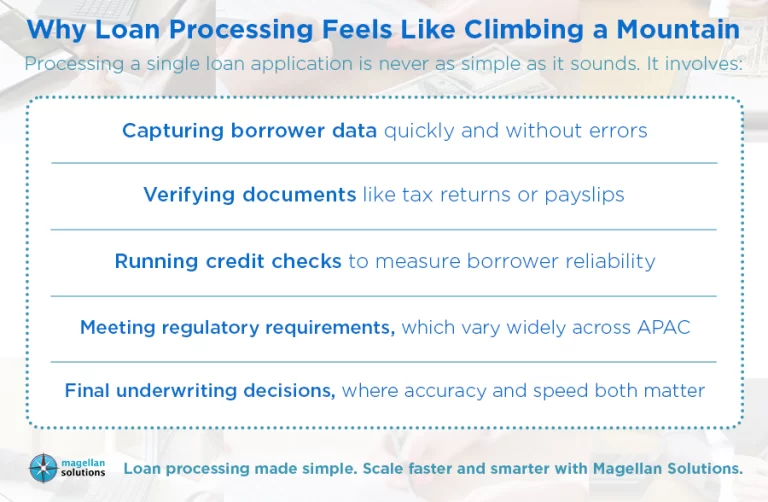

Most people see fintech as sleek mobile apps and lightning-fast transactions. What they don’t see? The avalanche of paperwork, compliance checks, and risk assessments runs in the background. Loan processing isn’t flashy, but it’s the engine that keeps fintechs alive.

Here’s the problem: customers expect approvals in minutes, regulators demand precision, and fintech firms often don’t have the manpower to balance both. Building big in-house teams can eat into profits. That’s where offshore outsource loan processing comes in—not just as a cost saver, but as a growth driver.

Offshore Outsourcing: More Than Just Cost Savings

So why are fintechs across APAC moving to outsource loan processing offshore? Because the benefits stack up quickly:

- Cost Efficiency That Frees Up Capital

Instead of burning cash on local back-office hires, outsourcing allows firms to tap into equally skilled offshore teams at nearly half the cost.

- Scalability On Demand

Loan volume fluctuates. Some months it’s quiet, others it’s overwhelming. Offshore partners let fintechs ramp operations up or down without missing a beat.

- Round-the-Clock Processing

Many offshore teams work across time zones, which means applications get processed even while local offices are closed. Faster turnaround keeps customers happy.

- Expertise Without Endless Training

Compliance across APAC is no joke. Outsourced professionals are already trained in global and regional regulations, so fintechs don’t waste time scrambling to keep up.

- Focus Back on Growth

Every hour saved from paperwork is an hour gained for strategy, product upgrades, or new market expansion.

The Proof Is in the Numbers

According to a study, 59% of businesses outsource to cut costs. For fintech firms, though, outsourcing isn’t just about trimming expenses—it’s about clearing roadblocks that slow down growth.

Pair that with the fact that the global fintech digital lending market is expected to surpass US$500 billion by 2028, and the message becomes obvious: companies that don’t streamline loan processing today risk falling behind tomorrow.

Where Outsourced Loan Processing Adds Real Value

Offshore teams cover the entire loan cycle, not just data entry:

- Data Entry & Indexing: Accurate borrower details, filed quickly.

- Document Verification: Careful review of IDs, payslips, and proofs.

- Fraud Checks & Compliance: Staying ahead of AML and KYC requirements.

- Underwriting Support: Clean, ready-to-review files for faster decisions.

- Customer Support Extensions: Multilingual borrower assistance to build trust in diverse APAC markets.

For borrowers, this means fewer delays and a smoother experience. For fintechs, it means processes that run smoothly and efficiently.

Why APAC Fintechs Can’t Afford to Miss This

Competition is fierce. Every digital lender is racing to offer faster approvals and better borrower experiences. But speed without compliance risks fines, while compliance without speed frustrates customers.

Offshore outsourcing bridges the gap—delivering both speed and precision. It enables fintechs to scale responsibly, maintaining compliance while processing more loans in a shorter timeframe.

Bottom Line

Loan processing is often treated as a back-office chore, but in reality, it’s the heartbeat of fintech growth. Offshore outsource loan processing gives APAC firms a way to stay fast, accurate, and competitive in a market where both customer trust and regulatory compliance can make or break a business.

The truth is simple: fintechs that keep clinging to in-house teams risk being buried under rising workloads and tightening regulations. Those that embrace outsourcing position themselves for sustainable, scalable growth.

Why Partner with Magellan Solutions

At Magellan Solutions, we’ve spent 19 years helping businesses turn back-office headaches into strategic advantages. Our offshore loan processing services cover everything from data entry to underwriting support—always with compliance and accuracy at the forefront.

If you’re ready to turn loan processing into a growth engine rather than a bottleneck, start with our Free Answering Service Trial. It’s a simple way to see how outsourcing can lighten your load. Visit Magellan-Solutions.com today and explore how we can help your fintech scale smarter, faster, and stronger.