Schedule a FREE call with our outsourcing expert now and get a precise quotation that meets your requirements. Don't wait - get started today!

The world has witnessed several devastating recessions that crippled local and international economies. Yet, time and again, businesses recovered and went back on track.

However, facing another recession is too much to bear, especially for small businesses with limited cash reserves. Even huge companies are not exempted.

Due to the continuous spread of the coronavirus disease (COVID-19), another recession is likely to happen. Many businesses have to cease their operations, leading to a massive unemployment rate.

With this looming threat, how can a recession affect a business? What should decision-makers need to do to survive in these uncertain times?

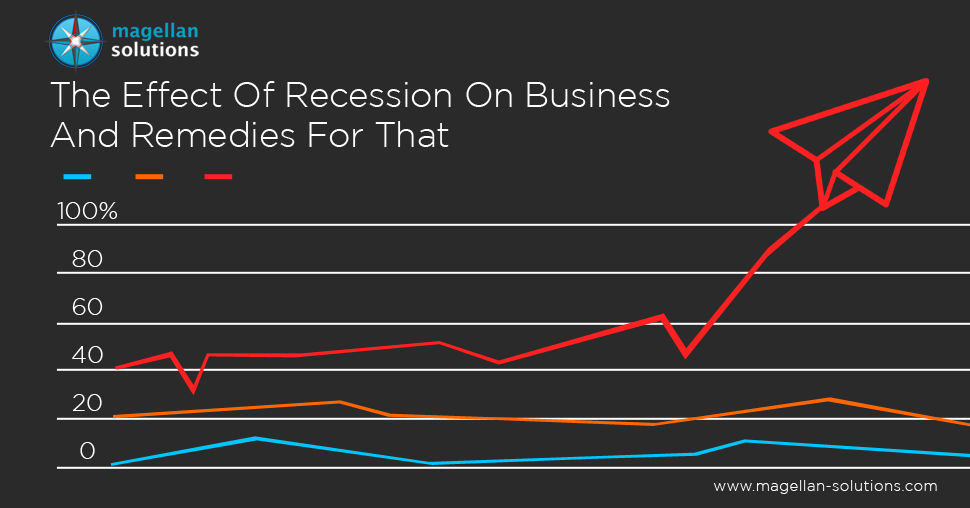

Recession Effect on Businesses

A recession can affect businesses in a variety of ways. Based on the results from Capital One’s 2019 Small Business Growth Index Survey, 85% of companies will experience the impact of a recession. See the figures below to see its potential effects:

- 61% of companies believe it would leave a negative impact on their cash flow

- 59% said it would decrease sales

- 43% are concerned with its effects on the business’s overall success within the next 12 months.

The effects of the recession are interconnected. The entire cycle will be in jeopardy once an element of the business equilibrium is disrupted.

See below the effect of recession on business and remedies for that.

Declining Demand

Because of inflation and layoffs, most consumers shift their purchasing power to necessities such as food, water, shelter, and electricity. When people lose job security, their primary instinct is to save their resources and to limit their usage.

With this mindset, businesses (especially from the non-essential industry) can experience a sharp decline in demand, resulting in lower revenue and poor cash flow.

Possible remedy: Look for ways to meet consumers halfway. See if you can offer products or services that will fulfill their needs. During a recession, you need to think out of the box if you want your business to survive. Reintroduce entry level services or products since a lot of them are cutting back.

Another solution is to reach out to a wider market.

The Lego Company is one of the prominent companies that take off during the Great Recession of 2008. Instead of staying in the U.S., it intensified its sales effort in the European region and experienced a 20-percent increase in consumer sales.

In reaching out to other markets, you can take advantage of the skills and cultural knowledge of an outsourced telemarketing team.

Reduced Cash Flow

Cash gives stability to businesses. It protects them from foreclosures and loan defaults. Having a positive cash flow enables them to move freely — purchasing and selling products and services to achieve their targets.

However, even without the recession, many small businesses operate on limited cash resources. When consumers limit their spending or delay their payment, small businesses and independent entrepreneurs can immediately feel its impact. It impedes their cash flow and limits their ability to operate. This is one of the primary reasons why business closures and layoffs happen.

Possible remedy: During a recession, it is crucial to closely monitor the amount of money coming in and out of your business. By doing so, you’ll have a clear grasp of your current financial standing, enabling you to prepare an action plan to deal with challenges in the present and the future.

If you’re already experiencing a negative cash flow, you can start recovering it by cost-cutting, seek out good loan programs for small businesses, or devising fast and convenient payment methods.

Bankruptcy

This is the worst possible effect of the recession on any business.

Not making enough revenues and receiving payment from your customers on time will have negative impacts on your accounts receivable (AR). If it happens, you’ll also be forced to pay your bills at a later date or smaller amount than the one you’ve agreed upon with your supplier or creditor. This could result in a reduced valuation of your debt or ability to gain financing.

Possible remedy: To ensure the constant flow of money coming into your business, consider implementing a strict yet reasonable collection process.

In case of bankruptcy, the first thing you need to do is to determine why it happened in the first place. From there, determine a strategy that will prevent it from happening again. It is also important to come up with a transparent financial report.

Meanwhile, some companies choose reorganization when faced with the threat of bankruptcy.

Staff Reduction

Negative cash flow can trigger businesses to reduce the number of their employees to cut costs. Companies see this as the fastest solution to stabilize their balance sheet again. However, this should not be the case. Instead, this is one of the last steps a business should take.

Layoffs create fear among employees who are, in fact, the primary consumers of many products and services. As they become more anxious in keeping their source of income, they will start to limit their spending. This can even extend the duration of a recession because the demand keeps on dwindling.

Possible remedy: Listen to the sentiments of your key employees. Gather all their suggestions and come up with a plan to keep and protect your employees as much as possible.

Effect on Product/Service Quality

Due to the desire to cut costs, the quality of goods and services might also suffer. But it does not stop there. It can also affect the desirability of the product.

Consumers become more price-sensitive during economic downturns. It goes beyond looking out for quality products or services that would last for a longer time.

Meanwhile, customers who only focus on the cost instead of the quality will hardly notice any change in the product quality.

Possible remedy: Before adjusting your products’ quality, conduct market research first. If you can, have a survey among your existing customers. Determine their values and their top priorities. This will help you move forward without worrying about losing your loyal customers.

Recession can affect everyone. In the end, the survival of your business depends on the decisions you make today.